Small businesses need help gaining access to capital in a timely and affordable way. Owners can have difficulty finding a lender, often don’t qualify for the right amount, and are left to deal with high costs once approved. Automated underwriting is a tool that SMB lenders can use to better serve clients facing these problems.

In this article, we’ll explain:

- What automated underwriting is and how it works.

- How it streamlines the process and helps both SMB lenders and their customers.

- What platforms lenders can use to get started.

- How automation can be used for the entire life of a loan.

What is automated underwriting?

Loan underwriting has traditionally required underwriters to manually review financial documents such as bank statements, credit reports, and other information to assess a potential borrower’s risk. Automated underwriting uses technology, fast data access, and artificial intelligence (AI) to automate much of that process, reducing the time it takes to evaluate a borrower and minimizing human error.

Automated underwriting streamlines four main steps of the underwriting process:

- Data collection: Financial data can now be collected much faster with technology such as application programming interfaces (APIs). Instead of borrowers figuring out how to get a PDF of their bank statements, pay stubs, and credit card statements, lending platforms can connect to bank accounts and payroll provider portals via APIs to retrieve this data in minutes.

- Data analysis: Automated underwriting systems use algorithms and machine learning models to analyze the provided data. They can check the debt-to-income ratio and judge the borrower’s ability to repay much faster than a human underwriter alone and potentially with less error.

- Risk assessment: Most automated underwriting systems provide a risk score based on the data analysis. This score predicts the probability that a borrower will default or miss payments.

- Decision-making: Some automated underwriting systems will decide whether to approve a loan without human intervention if the loan is under a certain threshold. Human reviewers usually review the results of the automated underwriting system before making an approval decision for higher-risk applicants or higher-value loans.

Underwriting automation streamlines the loan origination process

The traditional underwriting process is ripe for automation and disruption, especially in an age where more small-dollar loans such as buy now pay later (BNPL) are becoming commonplace. If a lender were to use automated underwriting to approve a BNPL loan, whether that be for a business or a consumer, they would see the following benefits:

- Faster approvals: It typically takes 1-10 days for a loan to be approved and funds disbursed. If you have customers who need working capital to keep their businesses running, getting those loans approved and disbursed faster can be critical. Automated underwriting can cut out manual processes and get a loan approved on the same day.

- Increased efficiency: Having an underwriter pour over bank statements and crunch numbers takes time and resources. In the age of automation, ChatGPT, and ocular recognition software, there’s no reason to have people do this. Instead, you can use automated underwriting tools to do the number crunching while people work on more critical tasks.

- Improved accuracy: While the numbers should be double-checked for higher-value or high-risk loans, machines can analyze large data sets more accurately than humans. You could trust the system to approve smaller-value loans without human intervention.

- Better customer experience: Nobody likes waiting, especially when they need fast access to funds, as in our working capital example above. A faster underwriting process with easier data sharing creates a better customer experience that could increase future business from satisfied customers.

How automated loan underwriting impacts SMB lenders

Most of Canopy’s customer base comprises fintech and SaaS companies that lend to small-to-medium-sized businesses (SMBs). SMBs often face difficulties in the traditional lending process. According to the Small Business Credit Survey, only 14.6% of SMB loans are approved by big banks, and 44% of SMBs worry they won’t qualify or get denied.

Also, SMB lenders typically have a closer relationship with their customers, so anything they can do to improve the customer experience will help them gain repeat business and more originations.

Automated underwriting provides the following benefits to both SMB lenders and SMBs themselves:

More originations: Faster loan application processing helps lenders handle and approve a higher volume of qualified applicants—and attract more applicants. Lenders like FundBox and OnDeck provide fast access to small business capital. Because lenders like these are known for being fast, more SMBs come to them to avoid the slower underwriting process that traditional business financing offers.

Faster access to capital: SMBs often don’t have weeks or months to wait for a loan decision. They may have time-sensitive opportunities to take advantage of or just need a bit of extra working capital to get through a slow season. For example, if an embedded SaaS lender in the restaurant industry can get working capital loans disbursed faster, they help more restaurants survive slow seasons. Faster access to funds allows their customers to stay alive, which means less churn and higher annual recurring revenue (ARR).

Simplified applications: SMBs don’t want to drown in endless paperwork when they need a loan, especially a smaller loan or one that provides emergency funds. Automating the data collection part of the underwriting process makes things simpler and more accessible for all.

More competitive terms: A streamlined underwriting process could allow lenders to offer better interest rates and terms—and offer them faster than their competitors. Better terms would help SMBs access more capital at a better rate and help lenders grow their portfolios.

Challenges in automated underwriting lenders should be aware of

While automating the underwriting process provides many benefits, especially to SMB lenders, there are some potential setbacks to be mindful of.

Data quality needs to be high: Data coming out is only as good as data going in. You should be sure that the data you’re getting is accurate and from trusted sources only. It’s potentially easier to fool an automated underwriter than a human one.

Human intervention: Automation doesn’t mean no human underwriters are needed. Complex cases, exceptions, or even certain dollar thresholds should trigger a human review, which makes the process take longer and cost more.

Regulatory and compliance issues: Lenders are subject to many regulations, such as the Fair Credit Report Act (FCRA). If you’re collecting and analyzing data through an automated system, you must ensure it complies with all relevant regulations and standards.

What automated underwriting systems can SMB lenders use?

Several automated underwriting platforms can help SMB lenders incorporate automation into their underwriting and origination processes. These platforms support the underwriting process in various ways.

Data aggregation and enrichment

For automated underwriting to work, you need access to a borrower’s data, ideally in a streamlined and automated way. Data aggregation platforms like Plaid, Finicity, and MX can help lenders gain instant access to borrower data via open banking APIs that connect financial accounts to lending platforms.

Getting instant access to financial data streamlines the data collection process, but these platforms can also provide data enrichment that helps lenders gain insights from the data. Plaid, Finicity, and MX all offer additional data enrichment, usually in the form of a report or a score, that can help automate large parts of the underwriting process.

Automated underwriting decision engines

Lenders can also integrate their underwriting process with automated decisioning engines. Companies like Ocrolus, LendFlow, and Experian offer products that use algorithms and machine learning engines to assess borrower data and create a loan risk score. These automated systems can use both traditional credit data and bank account data to determine borrower risk and quickly paint a picture of creditworthiness. Some of these platforms can also be integrated to the point that they make automatic underwriting decisions on your behalf.

While Canopy focuses on intelligent and automated loan servicing, we have a partner network of platforms that can help with automated underwriting and origination. Our partners have pre-built integrations with Canopy so that you can use automation throughout the entire loan process.

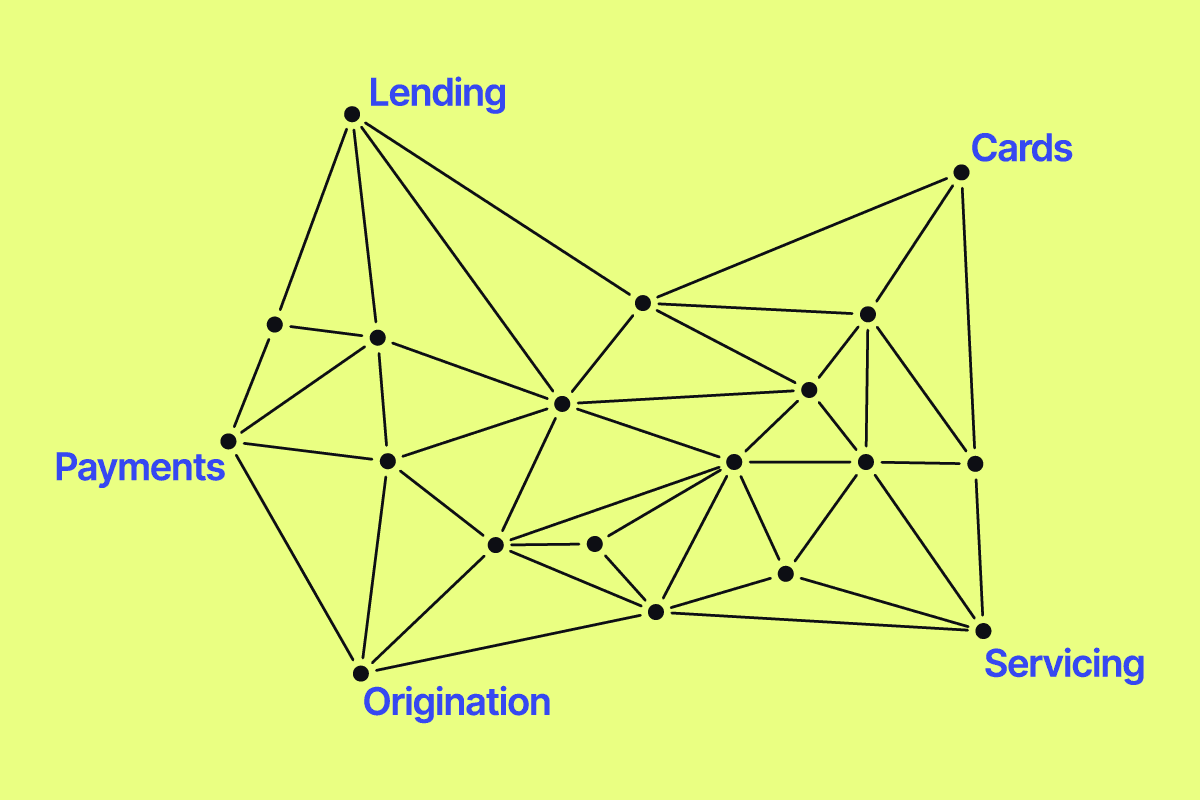

Automation goes well beyond underwriting and origination

Automating the underwriting process can help you grow your loan portfolio while increasing efficiency and cutting costs, but you still need to service all those new customers for the life of their loans. That’s where automated loan servicing takes over.

Canopy Connect is a workflow builder that can automate your entire loan servicing program and help you integrate with all the external platforms you use. With it, you can:

- Create custom workflows or use pre-built automations for every lending task.

- Connect with every platform that touches your loan servicing process, such as CRMs, reporting tools, and payment processing.

- Grow your lending products with custom integrations that help you scale with ease (this is especially important if you are taking on many new originations through automated underwriting systems).

Contact us to discuss how we can help you build a complete automated lending system through our automated underwriting partners and Canopy for automated loan servicing.