Many small business owners struggle to find capital to start and grow their businesses. Loans can be hard to find and take a long time to get funded through traditional credit systems.

Buy now, pay later (BNPL) has provided an alternative for consumers to get loans for everyday purchases, and it’s now entered the B2B space to give businesses a viable alternative to traditional banking and credit.

While companies like Klarna, Affirm, and Afterpay have taken off and created billion-dollar-plus valuations and pending IPOs, B2B BNPL is still in its infancy. However, it presents a significant opportunity—especially for small business lenders—to help businesses get the capital they need while adding profitable products to their loan portfolios.

Below, we’ll discuss how B2B BNPL works, the opportunity it creates for lenders, and how you can set up your own program.

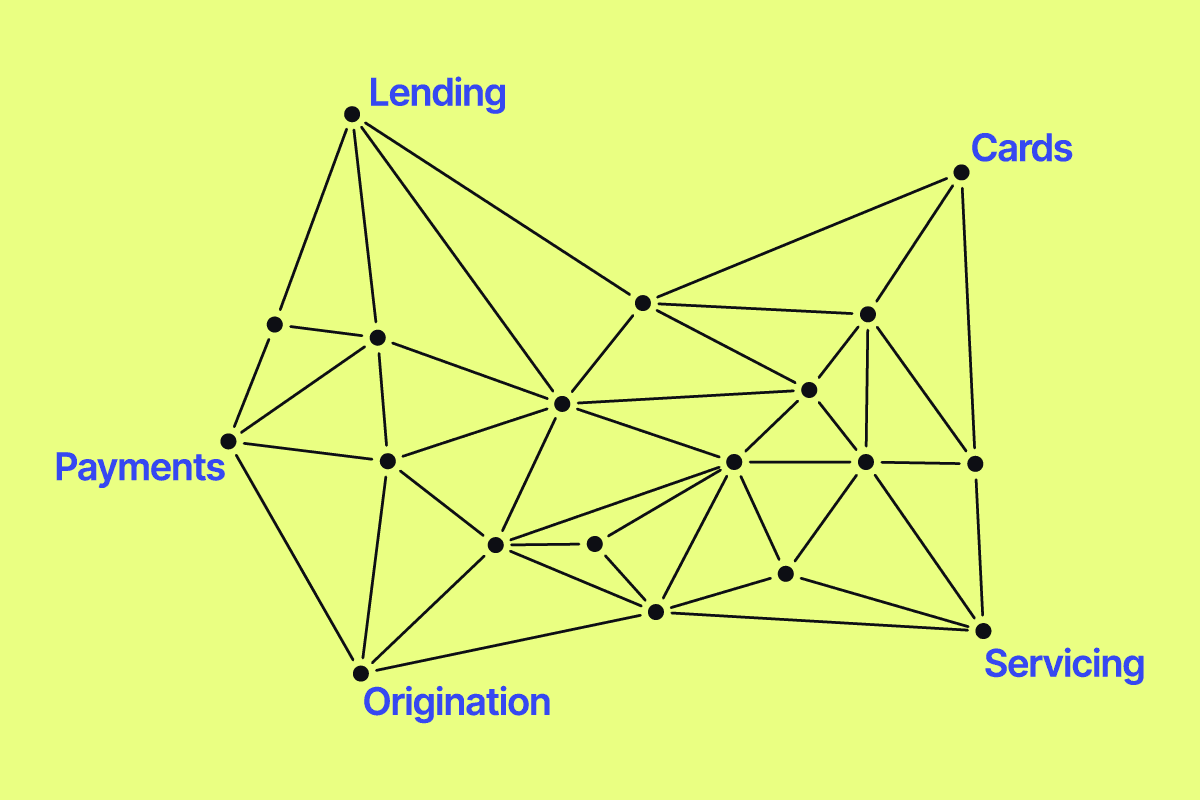

How does BNPL work in commercial lending?

BNPL works in commercial lending as it does for consumers during online checkout. Like with e-commerce, consumers are usually offered payment terms of either four, five, or six payments at the point of purchase.

Terms are typically dictated based on what a business is purchasing. For a high-end or non-risky purchase, they may get 0% financing, but for a riskier purchase, they could incur daily interest. Either way, the funding is for one specific purchase rather than an open-ended loan or line of credit that can be used for anything.

A BNPL option can be provided through a system such as Affirm or Klarna or through your own B2B purchasing portal.

Payment terms for BNPL should be friendly and straightforward for businesses to understand. It should show precisely what they will have to pay back and when—giving them the total repayment cost at the point of sale.

This makes it much easier to calculate future costs than with a credit card, where interest rates are charged based on recurring balances.

What opportunities does BNPL create for SMB lenders?

BNPL for B2B represents a sizable opportunity for small-to-medium-sized business (SMB) lenders. In 2023, the global B2B BNPL market size reached $14 billion in total spending, partially due to businesses seeking alternative financing during tough economic times.

While this is a good sign, it’s still a relatively small amount with much room for growth. There is a massive opportunity for SMB lenders, as small businesses often suffer with access to credit. Many of these small businesses, especially those run by Gen Z and Millenials, are already used to purchasing with BNPL through providers like Affirm, Klarna, and AfterPay, so it isn’t a stretch for them to make these types of purchases for their business.

Partnering with platforms like Canopy and others will be crucial for helping lenders create their own BNPL programs, which will help their small business customers gain access to an exciting new type of alternative capital.

Differences and similarities of B2C and B2B BNPL

Many small business buyers who use B2B BNPL companies will be familiar with the concept for everyday purchases. These processes are generally similar in how they are structured. Still, there are some critical differences in the types of purchases made and the underwriting and decisioning process for approving the loans.

Why small businesses are the perfect customers for BNPL

Many SMBs, especially newer ones, don’t have a long-standing credit history, which makes it harder to offer them a line of credit with traditional means. SMB lenders can use BNPL as an alternative way to provide capital to these business owners that might not qualify for a loan.

For example, if a small business gets a tax rebate, it could use its tax return to qualify for BNPL. It could also use cash flow data and other alternative credit information that isn’t usually available on a credit report.

In many ways, small businesses behave more like Gen Z and Millenials in the credit industry, while large companies are more like baby boomers and Gen X. They are more likely to use BNPL and other alternative payment and credit methods and less likely to use credit cards. As more Gen Z and Millennials become business owners, they will appreciate having BNPL as an option.

How does underwriting for B2B BNPL differ?

Unlike traditional business underwriting which can be a slow process, B2B BNPL underwriting needs to happen quickly at the point of purchase. Because it needs to happen fast, it must also be fully automated.

Factors that come into play for BNPL loan decisioning include:

- Who’s buying

- Who they’re buying from

- What item is being purchased

- The buyer’s recent transaction history

It relies on both cash flow data and data from the Know Your Customer (KYC)/Know Your Business (KYB) process. This can get complex quickly, hence the need for automation. A reliable BNPL automated underwriting partner is crucial to your program’s success.

How to set up a B2B BNPL program with automation and intelligent servicing built-in

To be successful with BNPL for business transactions, you need to create a system that can work immediately at the point of sale to identify and approve a customer for a single-item loan. The first steps must be heavily automated, but you can also automate downstream workflows such as collections.

Step 1. KYB

Identity and business verification is the first step in giving out a B2B BNPL loan. This is known as KYC for consumers, but for businesses, it’s called KYB. The KYB (know your business) process consists of doing your due diligence to ensure that the company you’re lending money to is a legitimate entity, not a money laundering or terrorist organization.

The KYB process identifies the name of the company, its shareholders, and gathers details such as addresses, business licenses, registrations, and ID documents. Owners and shareholders are checked against anti-money laundering (AML) and politically exposed persons (PEP) checklists. Most companies run these checks when onboarding new customers, but you should also run checks against these lists for each new loan.

Step 2. Underwriting

As mentioned above, B2B BNPL underwriting must happen quickly and be heavily automated. The underwriting process will vary based on the company making the purchase, the product being sold, and the cash flow data you get from the customer.

B2B BNPL underwriting can be more complicated to set up than typical underwriting because of the need for automation and instant approval. Once it’s set up, however, the payment terms are much clearer than those of a line of credit or other type of business loan. You’ll typically be paid back in four, five, or six payments over a given period of time.

This helps the business get an exact idea of how much they’ll spend on this purchase. The simplicity of these loans eliminates the need for more detailed credit reports. Still, you will likely want to use a data aggregator to pull bank account transaction data to ensure that the business has a reliable cash flow to pay back the loan.

Canopy integrates with automated underwriting providers who can help you set this up.

Step 3. Servicing and Collections

Finally, you need a collection system for B2B BNPL payments, which should be relatively simple but needs to work without human intervention. This is where Canopy comes into play.

Using CanopyOS, you can manage BNPL loans alongside your other lending products. You can quickly build your automated collections workflow and monitor all accounts as payments come in. You can flag accounts needing further intervention if a payment is missed or late.

As part of our intelligent servicing tools, you can always adjust loan terms to give customers leeway, which can help boost average repayment rates by up to 30%.

Test your own B2B BNPL program before launching

Using products like Canopy Connect and LoanLab, you can connect all the tools and processes you need to create a seamless B2B BNPL program. You can test configurations and integrations to see how your program will work and even project long-term profits.

Ready to set up a business BNPL program? Contact us to learn how.