Banks aren’t the only ones providing business loans in the modern world. Embedded lending has turned more everyday businesses, such as SaaS companies, into lending businesses. However, these alternative lenders don’t have the same technical resources as banks to manage a complex lending business.

That’s where business-to-business (B2B) lending platforms come in. These platforms provide non-bank lenders with the tools they need to intelligently service their customers, gather all the data and insights from the entire lending process into a system of record, and use those insights to grow their business.

In this article, we’ll explore how B2B lending is different (especially for alternative lenders), how B2B lending platforms work, and how you can use a B2B lending platform to serve your customers better and grow your lending business.

What is B2B lending, and how is it different from other types?

Most people are familiar with traditional B2B bank lending (i.e., getting a loan from a bank) to start or grow a business. While this is a type of B2B lending, it isn’t the only one. There are many ways businesses get loans and other loan providers than banks.

Small and medium sized businesses (SMBs) can get different types of loans, such as:

- Working capital: Day-to-day expenses to keep the business running, such as payroll or inventory.

- Merchant cash advances: A lump sum loan, more typical for e-commerce and retail, paid back through a percentage of credit card sales or fixed daily debit.

- Line of credit: Instant access to funds for anything a business needs, with the funds paid back like a credit card.

- Installment loans: A specialized loan, usually used for expanding or growing a business, repaid in installments, much like a mortgage or auto loan.

- Equipment financing/BNPL: A one-time loan for purchasing equipment, machinery, or other large ticket items. These are paid back as a buy now, pay later (BNPL) loan, usually in four, five, or six payments.

Businesses can get these loans from a bank, but many struggle to secure them, with only 14% of small business loans get approved by traditional banks. As a result, many small business owners are now getting loans through embedded lending providers. These are typically software-as-a-service (SaaS) companies that serve a specific industry (such as home contractors) or fintech neobanks (digital banks) that offer alternative financing options.

Embedded lending is a growing market expected to reach $23.31B by 2031. It is also becoming increasingly common to leverage alternative lending providers. For SaaS and other companies that want to offer loans, using a lending as a software (LaaS) platform, such as Prime can help them get started.

How does a B2B lending platform work?

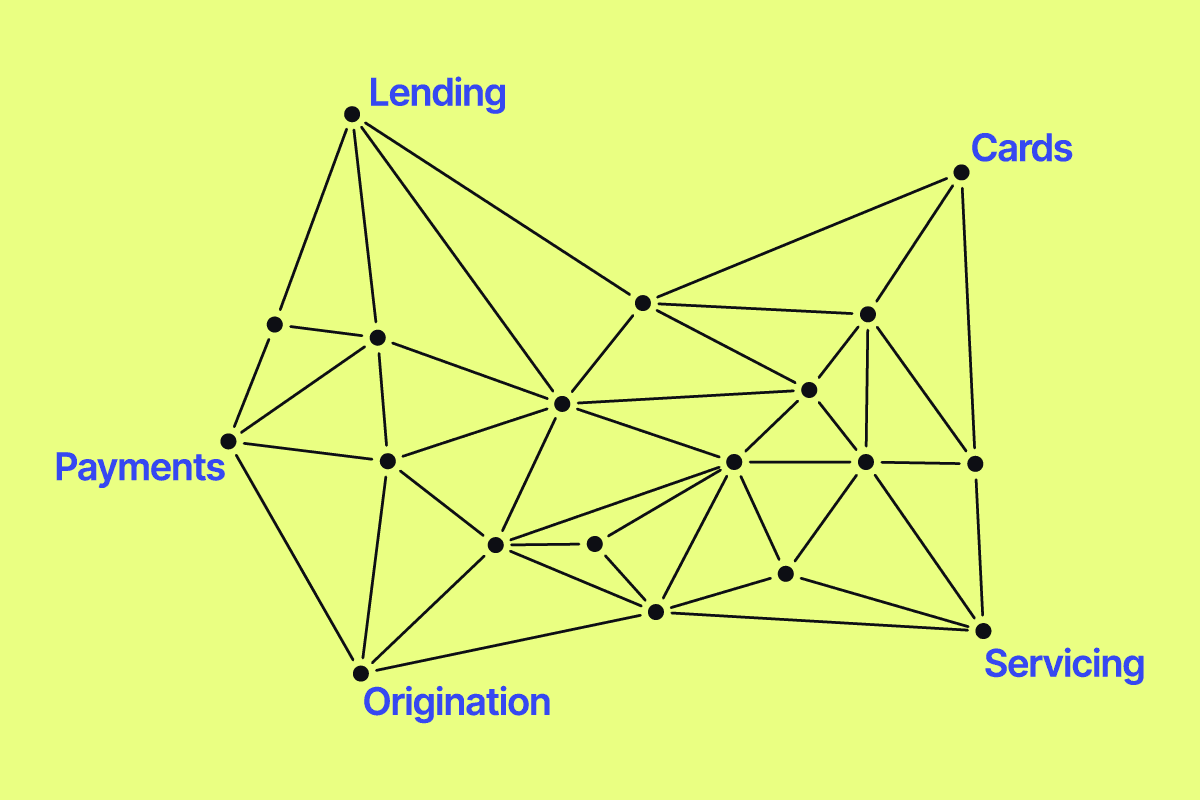

The B2B lending process has many parts. These include application processing, underwriting and approval, disbursing funds, and loan servicing. Servicing the loan is the last stage, affecting most of your loan’s lifecycle and making up the bulk of the customer relationship.

That’s why we consider a B2B lending platform as something that manages loan servicing for your entire portfolio. A platform should be able to handle all of your loan products and be a system of record for every customer, loan, payment, and more. It should provide valuable data and insights to help you better service your customers and grow your business.

However, the beginning stages of B2B lending are essential, so it’s important to integrate your lending platform seamlessly with your loan application and underwriting systems.

When looking for a partner or solution, make sure they can integrate with those programs. Ideally, they have a healthy technology ecosystem with multiple partners you can choose from to work with on things like origination, payment processing, issuing, accounting, customer relationship management, debt collections, credit reporting, and more.

A trustworthy B2B lending platform will integrate with every piece of the loan puzzle and act as your system of record. Through API connections, you should be able to view all data inside the system for each customer account, acting as your source of truth for everything in your B2B lending business.

B2B lending software vs. B2B lender portal

There needs to be some clarification on the difference between B2B lending software (aka platform) and a B2B lender portal. B2B lending software is what you use to manage your end of the business. It’s where you see all customer loans, types of loans, terms, expected payments, total balances, and more. It’s essentially the operating system for your lending business.

B2B lending portals, on the other hand, are systems that you provide to customers about their loans. It’s similar to what you might see when logging into your mortgage lending website, where you can see the remaining principal, account statements, payment history, and amortization schedule, but for a business loan instead.

Benefits of using a B2B lending fintech software

For a non-traditional lender, such as a SaaS-embedded lender, managing a portfolio of loan products and customers could get messy without an integrated platform. While they may use different solutions for underwriting, applications, and servicing, they still need a system of record to see and manage everything from.

A B2B lending platform can provide SMB and SaaS lenders with the following benefits.

Easier to launch new products

Customers will want access to different types of loans, whether working capital, installment, or BNPL loans for a single purchase. With a B2B lending platform like Canopy, you can simulate new product variations with different accounts and validate how accounts will behave. This enables you to create new lending products that are most effective for your business. You can also test various scenarios, such as what happens when an account goes delinquent, late fee amounts, or what happens with partial payments.

Ability to cross-sell existing solutions

One of the great things about using a B2B lending solution is that it aggregates all of your customer data and provides insights you can use to promote other loan products at the right time.

For example, if you have a high percentage of customers in a particular segment frequently using BNPL loans to make equipment purchases, you could use that as an indicator that other customers in that segment might also want BNPL loans. You could promote BNPL to similar customers who might not know you have it and increase your loan portfolio and profitability if more customers use it.

Get analytics and reporting on your customers and portfolio

Having a system of record for all loan activity means that all data flows into a single platform for reporting and analytics. You can measure your portfolio’s overall performance and risks by tracking metrics such as new originations, total loan balances, repayment rates, and more. This portfolio data can help you assess how macroeconomic events in your industry are affecting your customers and know when to take action to prevent them from defaulting.

Alternatively, you can get granular with single customer accounts to see statements, outstanding debt, account status, and more. You can also search for types of accounts that could benefit from other loan products and promote them to them (mentioned above).

Flexible and easy loan servicing

Using a B2B lending platform makes it easier to proactively communicate, identify hardship, and collect payments, which encourages more on-time payments. You can also use it to intelligently service loans, responding to how your customers’ businesses perform.

A lending platform should let you set up flexible loan terms that can be adjusted based on your customer’s needs. For example, if you work in an industry with low seasons, you could create a payment plan that requires a higher payment during the busy season but no or low payments during the slow season. Intelligent servicing like this has helped Canopy customers increase their repayment rates by an average of 30%.

Spend less on maintenance

Servicing and maintaining accounts manually or via antiquated systems like spreadsheets can be costly because of the increased time and labor costs. Additionally, it will take longer to notice missed payments and delinquent accounts.

B2B lending platforms let you automate the servicing process, including missed payment notifications, payment reminders and confirmations, account statement updates, and more. This method costs significantly less than other methods and identifies problems early on so they can be addressed either automatically or with human support.

B2B lending partners can help you create the integrated solution you need

While a platform is necessary for loan servicing, a proper system of record that shows all data from applications, origination, and servicing will provide the insights you need to run a profitable business. It’s critical to look for a partner that can provide a business loan servicing platform that integrates with every other part of your business.

Through technology like APIs, webhooks, and direct data access, Canopy provides a low-code solution for managing your loan business. You can control the customer experience, seamlessly manage the backend, pitch new solutions to customers who need them, and service loans intelligently to fight off delinquencies while increasing on-time payments.

Learn more about how Canopy works as the operating system for your lending business, or contact us to schedule a conversation about how it can work for you.