It’s a new era in lending, with a blue ocean of opportunity available to those offering commercial and SMB loans. Are you staying ahead of the curve?

Introducing The Lending Innovator by Canopy Founder & CEO, Matt Bivons. Written for those building loan and credit products, this new series provides tips and insights from leaders in the credit, lending, and BNPL space.

And in case you missed our first issue, here’s a TL;DR

Many will argue that there’s already been a lot of innovation in lending. After all, some of the OG “fintech” players were lending companies.

They have a point, but I argue that there are still key changes that need to be made to unlock the next revolution, which will be bigger than those before it.

Lessons from the 90s

Let’s take a step back to the 90s, a big era for consumer lending innovation, with Nigel Morris and Rich Fairbanks applying personalization to credit card offers through risk based pricing.

Before Morris and Fairbanks came along, lending decisions took all of the buying, spending, and repayment habits into account to combine them into one risk score, but only looked thirty days back and lacked forward-thinking.

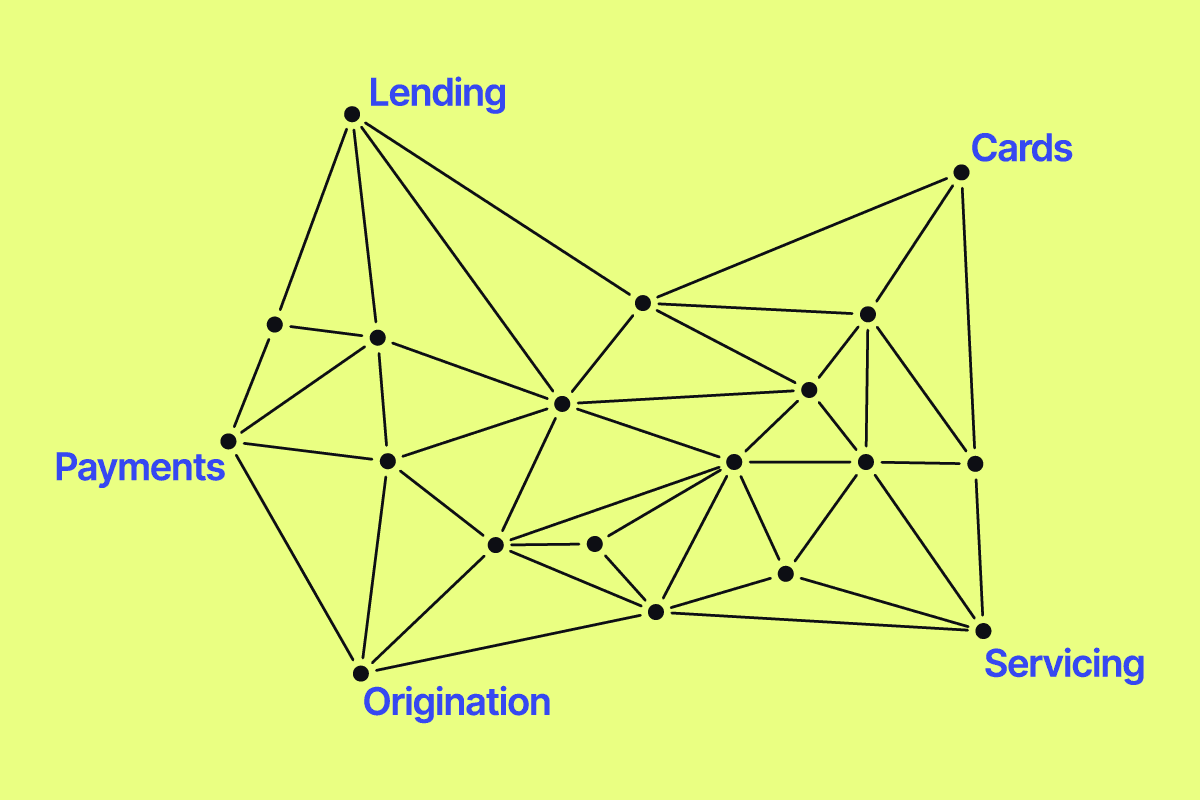

While consumer lending has been iterated on again and again, B2B lending has been moving at a snail’s pace. A lot of that had to deal with what’s going on behind the scenes. It wasn’t until recently that loan management and servicing software has begun changing to meet the ever-evolving needs of consumers and businesses, reflecting their demands for customized, transparent, and safer credit and lending products.

A better user experience for B2B lending

With this new framework taking hold, we’re better able to enhance the user experience and create better systems for all parties involved.

Take factoring for instance, which is a type of lending that involves the purchase of a company’s invoices by a third-party financial company called a factor. Essentially, the factor provides immediate cash to the company in exchange for its outstanding invoices. The factor then assumes responsibility for collecting the payment from the company’s customers when the invoices become due. I believe factoring will play a key role in B2B innovation, and is in many ways the B2B equivalent to risk based pricing for B2C lending.

The next decade of lending will look very different than the last. Given how much B2C lending has resulted in undifferentiated commodities, it’s time to turn the focus on the blue ocean of commercial lending.

Canopy has the good fortune of being in the trenches with our partners and playing a role in helping them innovate. We see new policies and rules being applied to different B2B use cases every day, while new working capital products are launching to fill a massive void.

Our partners, like Flexport and Novo are leveraging Canopy to be better operators of their own lending programs, which ultimately creates better borrowers. This moment has similar characteristics to other critical inflection points in fintech history.

The timing is ripe for disruption. With better infrastructure, access to new data types and massive demand from SMBs and merchants, this vertical of lending is an operator’s dream. We can’t predict the future and no doubt there will be surprises along the way, but the signal is clear – and in the words of a16z, it’s time to build.