What sets embedded lenders apart are dynamic and customized financial products that are in sync with the ebbs and flows of their customers’ lives. Embedded lending shouldn’t be limited to basic types of loans with pre-set, inflexible payment plans.

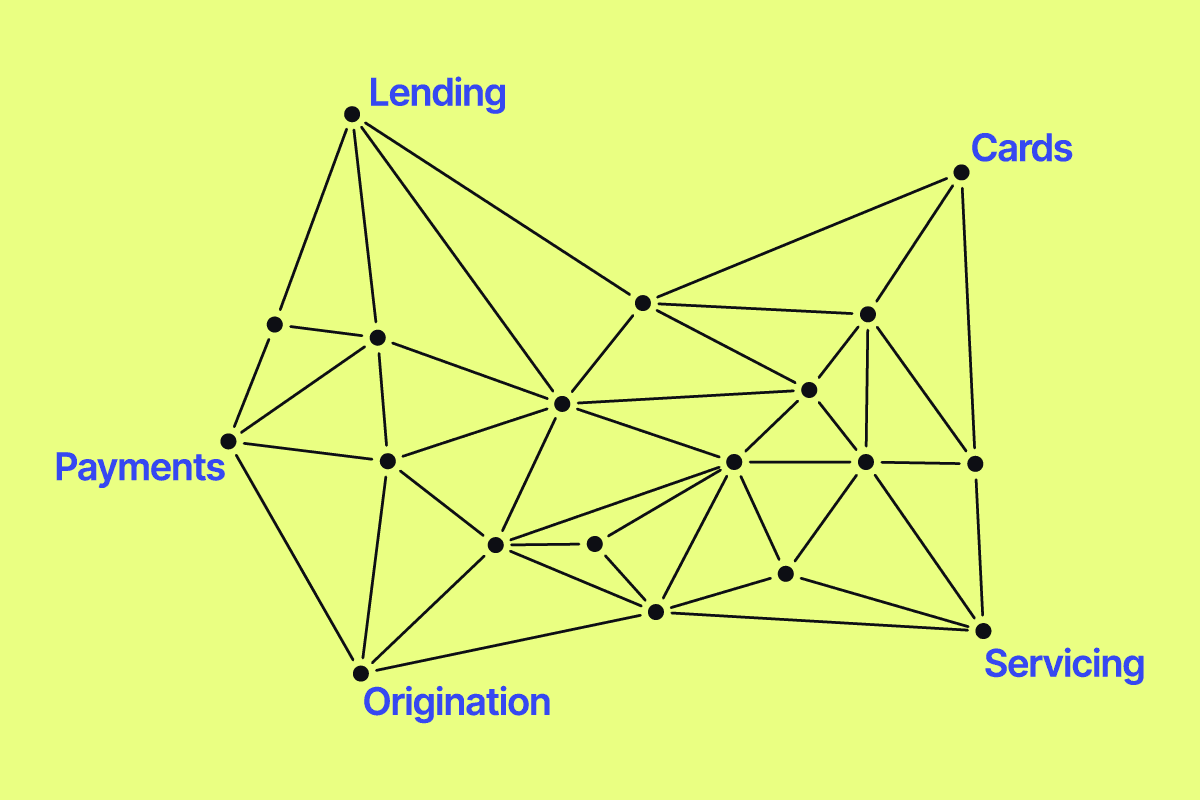

While many start with more rigid financial products, such as charge cards, the next step in the evolution of embedded lending often leads to more flexible revolving credit cards. However, offering a revolving credit card requires functionality that many lending platforms aren’t equipped to deliver.

In this article, we’ll break down what it takes to offer a revolving credit card product built for modern lending that includes features like:

- Incorporating flexible rates and promotion periods.

- Natively supporting non-happy path scenarios, such as payment deferrals and loan restructuring.

- Distinguishing between regular purchases, cash advances, and balance transfers to unlock hyper-tailored card products.

Going beyond the basics—The limitations of card issuers

Some lenders believe that a standard card issuer and payment processor are sufficient to offer revolving credit. While these companies handle transactions, many of them are limited to simpler products, such as debit cards or charge cards, that require payment in full each month.

The reality is that revolving credit products are complex and require advanced functionality to handle unconventional scenarios. Many legacy processors do not allow lenders to offer grace periods, various interest rates, cash advances, and balance transfers.

|

Simple vs complex credit products

|

|

|

Charge card |

Revolving credit card |

|

|

Some neobanks and other fintech lenders are stuck with rigid repayment terms on their revolving credit products. They are unable to offer grace periods, temporarily reduce payment amounts, or restructure the payment into an extended period. When facing temporary setbacks, as many businesses do in seasonal or variable industries, their customers often default on their loans, but this wouldn’t happen if they were more flexible.

When your ledger holds you back

At the core of what holds lenders back from better revolving credit products is an inflexible ledger. A ledger that can’t be adjusted, as found in many legacy platforms, hinders lenders from developing innovative and flexible products.

Lenders end up limited to the rigid loan types and repayment plans that their ledger allows. Flexible actions, such as restructuring payment plans and offering grace periods, are typically not supported by legacy platforms, which is why many lenders get stuck with inflexible servicing.

Lenders with a flexible ledger, which allows them to adjust payment plans as needed, benefit from higher repayment rates and fewer customer defaults on their loans. Canopy customers who switch to flexible servicing see an average of 30% higher repayment rates.

→ Read our whitepaper to learn more about building an alternative ledger with more flexibility for innovative products.

The four keys to building revolving credit

To build a revolving credit program that allows for the flexibility necessary to keep your portfolio healthy over the long term, these four components must work together in harmony.

- Issuer Processor: The processor is the foundational layer for managing card transactions. Many processors can issue physical and digital cards, but they don’t allow for flexible repayments, so they’re limited to debit or charge cards. Look for an issuer processor that can handle the backend logic of a flexible revolving credit product.

- Configurable Ledger: The ledger, your system for recording all financial transactions, is the engine behind your lending product. A rigid ledger will only allow for ‘happy path’ scenarios, or the loan will automatically default, while a flexible ledger allows for other paths that keep more accounts current. A flexible ledger supports dynamic scenarios such as the ability to edit credit limits and payment terms, extend grace periods, restructure, and refinance easily.

- Flexible Servicing: Servicing, which includes collecting payments, sending statements, handling missed payments, and all other borrower communication, must also be adaptable to account for dynamic or ‘non-happy path’ scenarios. An inflexible servicing system will not proactively identify and offer support to at-risk customers. Instead, it will automatically default them and start the collections process. A proactive, flexible servicing system will offer temporary grace periods and loan restructuring before default happens. Advanced servicing systems can also increase or decrease credit limits in real-time based on a borrower’s assets, like inventory, invoices, or daily sales volumes.

- Built-in compliance: For revolving credit products, compliance must be integrated into all systems from the ground up. For consumer credit, this includes managing information requirements for regulations like the SCRA (Servicemembers Civil Relief Act). For secured lines of credit, platforms must be equipped to produce information for legal filings such as UCC-1, which is a public notice of the lender’s security interest in the debtor’s assets.

The hidden costs of legacy technology

Legacy loan management systems (LMS) aren’t typically built for the needs of modern lending. They struggle with basic loan servicing adjustments and hold lenders back from offering simple features like adjustable payment dates. Customers are seeking seamless experiences and products that cater to their flexible needs, and they will continue to look elsewhere if a lender fails to meet these expectations.

The process of building and managing revolving credit is complex and requires an LMS and ledger that is pre-built to handle that complexity. Otherwise, lenders either get stuck offering only simple loan products, such as charge cards, or have revolving credit products with rigid servicing that can’t serve ‘non-happy’ path scenarios.

Build modern revolving credit with Canopy

Canopy is a loan management system that’s purpose-built for lenders seeking to build modern, flexible loan products. Its configurable ledgering and servicing capabilities support the complexities of revolving credit, enabling lenders to create the products their customers need.

Canopy also offers a revolving credit card product that handles the end-to-end processes of modern credit card management. It enables users to make purchases, withdraw cash, and carry balances with interest. It also comes with the flexible features needed to stand out in the lending space:

- Grace periods that allow users to avoid interest.

- Tiered APR structures for purchases, cash advances, and balance transfers.

- Rewards program integration for cashback, miles, or points.

- Dynamic credit limits and balance tracking.

Looking to build a revolving credit card offering that meets the needs of today’s customers? Contact Canopy to talk about getting started.