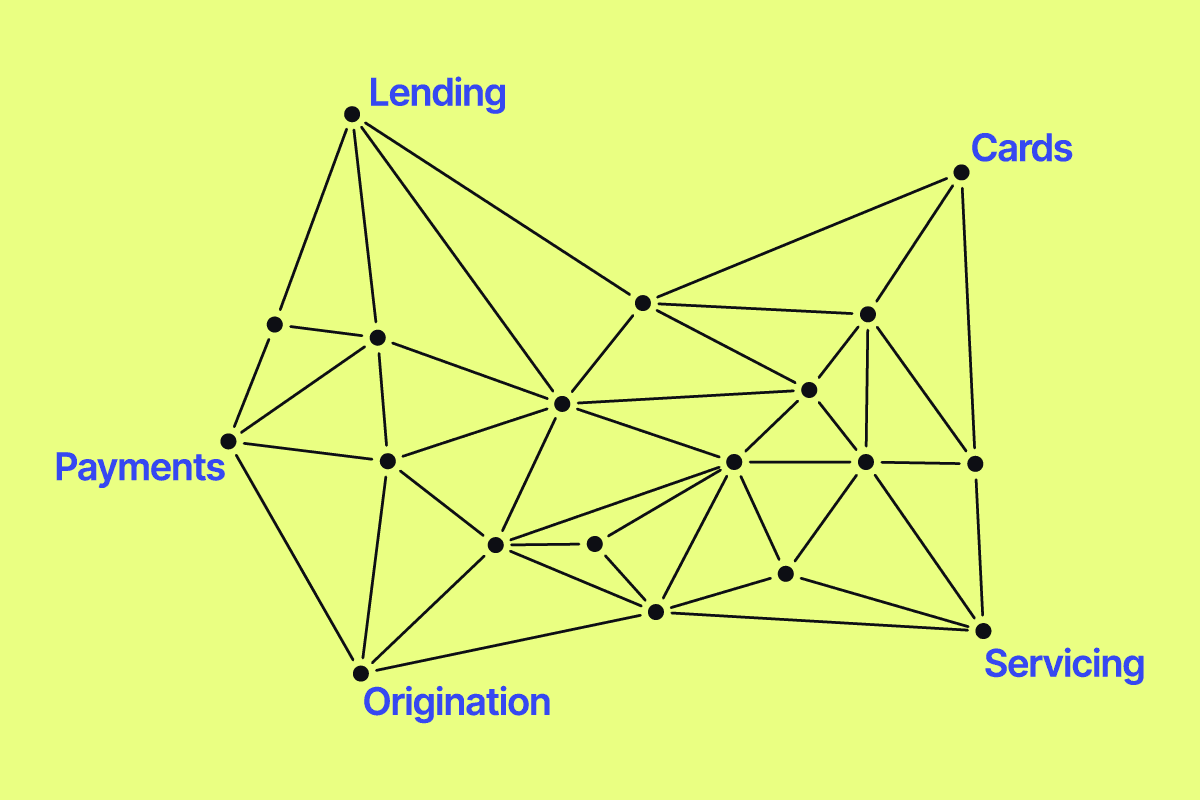

Scaling a B2B lending product can be a pivotal step for many businesses, offering new revenue streams and deepening customer engagement. However, it can also be fraught with unique challenges that can harm your business if not carefully managed. Based on insights from industry experts and experiences from various companies, here are some of the unexpected challenges and ways to be prepared for scaling your program.

Challenge 1: Adverse Selection and Credit Risk Management

One of the primary challenges in scaling a lending product is managing adverse selection, where the least creditworthy borrowers are often the first to apply. This requires robust credit assessment frameworks to mitigate risks. Effective risk pricing, proprietary borrower insights, and continuous tracking of underwriting decisions are essential.

Attract the right borrowers:

- Create strong requirements. Develop strong credit requirements to attract quality applicants. Using a decisioning engine like Taktile or Lendflow can help streamline this.

- Leverage borrower insights. Utilize proprietary data such as financial statements, debt-to-income ratios, and capital projections.

- Use continuous monitoring in underwriting. Implement continuous monitoring and backtesting of underwriting decisions. This way, if the business’s cash flow changes, you’re aware of the risk.

Challenge 2: Leveraging the Right Data for Product Development

Data plays a crucial role in the success of lending products. Without it, you risk mistakes in underwriting, subpar loan monitoring, and uninspired product decisions. Meanwhile, it can be incredbibly useful to target customers, customize products, and better manage risk.

Here are a few ways to use data to your advantage:

- Create products for customer needs. You can tailor products to meet your customers’ needs with the right data. This could be a revolving line of credit for a restaurant that’s expanding with a new location or equipment leasing for a trucking company.

- Make strategic product decisions. The data you gather can also be used to decide if and when it is the right time to scale. Would enough of your qualified customers need the new type of loan you plan to offer? What signals can you start tracking?

- Guide data models. Always update and refine data models based on customer behavior and market trends. If you’re using old data, your timing and decision-making capabilities will be less accurate.

Challenge 3: Maintaining a Flexible Infrastructure

To avert delinquency rates, more flexible and proactive repayment and restructuring capabilities are needed. This requires substantial time and a large capital commitment. Partnering with technology providers early on can streamline processes and enhance reporting capabilities.

Set your lending program up for success:

- Invest in flexible and scalable ledger systems. A big selling point is offering your customers flexible solutions that grow with them (whether their business expands or market conditions tighten).

- Partner with technology providers to ensure robust infrastructure. Building a scalable and flexible program isn’t all on you. The right partners can help you achieve a reliable infrastructure that allows you to achieve long-term growth.

- Transition to advanced solutions as you scale. As your business and customer base grows, so does the need for advanced tools and custom solutions. The model that worked in stage one of testing out a new offering may not be as effective once you’re live with multiple customers and looking to launch additional services.

Challenge 4: Strategic Timing and Product Integration

Determining the right time to introduce lending products is a strategic decision. Whether to lead with financing to attract customers or to use it as a monetization tool later depends on the business model and market conditions. Aligning lending products with the overall business strategy is crucial.

Here are a few ways to get alignment on the strategic vision early:

- Consider the demand. When launching lending products, consider market demands and timing. Conduct thorough market research to understand your target customers’ current needs and preferences. This helps identify the right time to introduce lending products to effectively meet market demands.

- Integrate everything. Use your product offerings to integrate new financing entry points. This could include bundling lending options with other services, creating seamless user experiences, and ensuring the new products complement your core offerings.

- Align with your mission. Match lending initiatives with broader business goals and customer needs. Ensure that your lending products support your overall business objectives and are designed to meet your customers’ specific needs. This alignment helps create a coherent strategy that drives growth and customer satisfaction.

- Establish feedback loops with customers and stakeholders. Regularly gather feedback from your customers and team members to understand their experiences and identify areas for improvement. Use this feedback to refine your lending products and ensure they continue to meet market needs.

Challenge 5: Managing Risk and Compliance

Scaling a lending product involves navigating complex risk management and compliance landscapes. Accurate data and reporting are crucial for maintaining compliance and effectively managing financial risk.

Get ahead of risk management:

- Establish strong risk management frameworks. Develop and implement comprehensive frameworks tailored to your lending product. This includes regular risk assessments, stress testing, and contingency planning to mitigate financial risks.

- Ensure compliance with regulatory requirements. Stay current with all relevant regulatory requirements to ensure your lending program is fully compliant. This includes adhering to anti-money laundering (AML) laws, Know Your Customer (KYC) regulations, and other industry-specific compliance standards.

- Maintain accurate, transparent reporting. Implement robust financial reporting systems to ensure transparency and accuracy. Regularly audit your financial statements and reports to promptly identify and address any discrepancies.

Challenge 6: Adapting to Market Changes

Interest rate fluctuations and economic conditions can impact lending programs. Developing strategies to adapt to these changes is essential for maintaining profitability and managing risk.

Be ready for any situation:

- Develop flexible pricing strategies. Create adaptable pricing models that respond to changing market conditions. This includes variable interest rates and adjustable loan terms that can be modified based on economic indicators.

- Monitor economic indicators. These indicators include interest rates, inflation, and unemployment rates. Adjust your lending terms and risk management strategies accordingly to mitigate potential impacts.

- Build long-term relationships: Develop strong relationships with your borrowers to create loyalty and trust. This will help you better understand their needs and offer personalized solutions that can withstand economic downturns.

Challenge 7: Getting and Maintaining Funding

Securing and maintaining funding requires building long-term relationships with investors and continually showing the value for borrowers. Clear communication, alignment of goals, and flexibility are key to nurturing these partnerships.

Here are a few areas we see business lenders focusing on early:

- Identify funding sources that align. Focus on building long-term partnerships with credit providers aligned with your mission. For instance, if you support a niche vertical such as wellness studios with a unique financing product, look for investors who have built a portfolio that includes one or two businesses in that vertical.

- Communicate progress: How is your program doing? Where could you use support? Ensure regular and transparent communication with investors. Some clients maintain transparency with automated business health reporting via their BI tool or Canopy Connect.

- Develop a path: Align funding strategies with business growth and customer needs. Knowing your path to scaling and having a strong understanding of demand will allow you to align with your partners and prevent hiccups as you grow.

Need help with your first round of funding? Check out our recorded live session, Securing Capital For Your Commercial Lending Program, for a summary of how to get started.

Sustainable Growth is Within your Reach

Scaling a B2B lending product presents several challenges, from managing credit risk to building a scalable technological infrastructure. By leveraging data, aligning strategic goals, and partnering with the right minds, businesses can navigate these challenges and achieve sustainable growth in their lending programs.

Ready to learn more about scaling your lending business? Get in touch with our team.