Technology and economic models play pivotal roles in shaping the success of lending programs. As businesses look at launching or refining their commercial lending offerings, understanding the interplay between technology selection and choosing the right economic model—between brokerage and balance sheet approaches—becomes crucial. This blog will give your deeper insights into the strategic considerations for selecting technology partners and deciding on the most suitable economic model for your commercial lending offerings.

Choosing the Right Technology Partners

The first step in creating a robust commercial lending program is selecting the appropriate technology vendors. This decision can significantly impact your program’s efficiency, scalability, and ultimately, its success. The modern financial landscape demands a careful balance between in-sourcing critical functions that drive competitive advantage and outsourcing commoditized aspects for efficiency and connectivity.

There are several factors that should be taken into account when deciding to develop technology in-house or to engage with external vendors. For example, strategic in-sourcing is often preferred for functions that directly affect customer experience, proprietary risk models, and client targeting. These areas offer opportunities to build distinct competitive advantages, enhancing client satisfaction and fostering business growth.

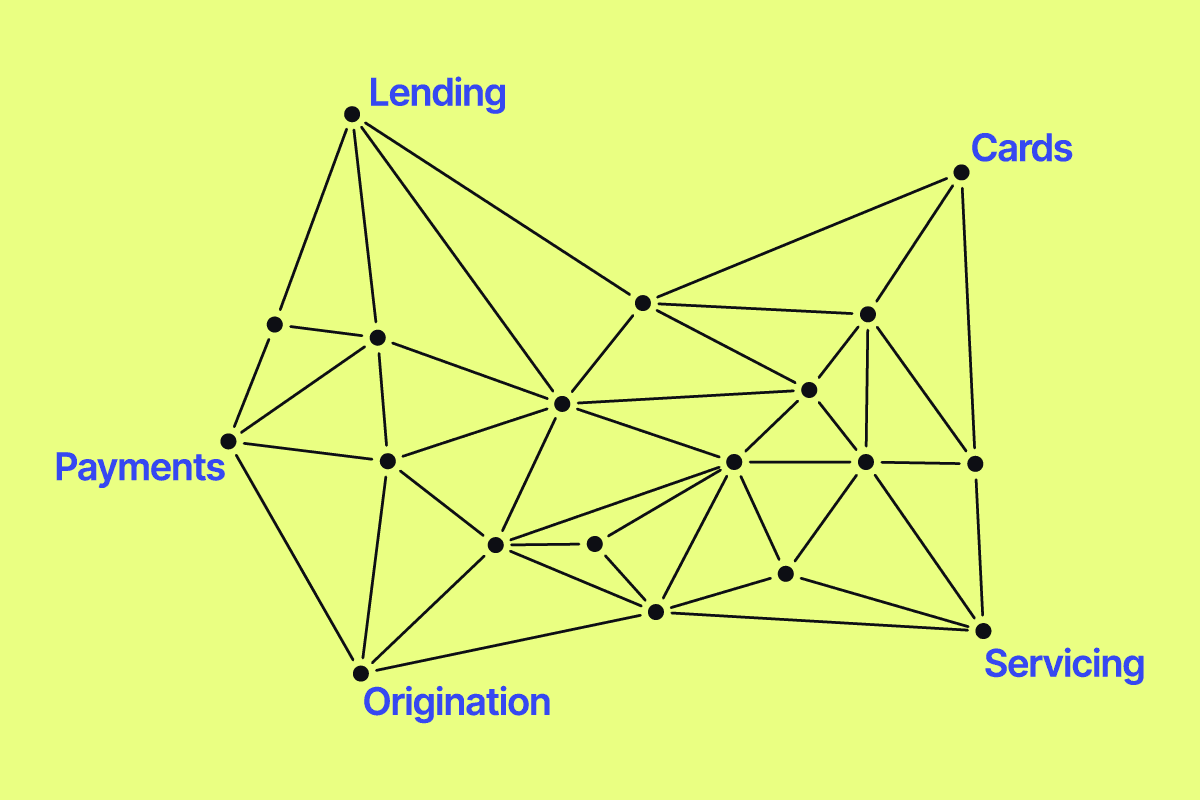

Aspects like payment processing, loan ledgers, and connectivity to third-party data sources can be efficiently outsourced. Partnering with established vendors for these services can expedite deployment, ensure compliance, and provide scalability without the need for substantial in-house investment.

When evaluating technology vendors, here are some items to consider:

- Where is their technical expertise

- What experience do they have within the financial sector

- Do they have the ability to meet your specific needs

Integration capabilities, compliance with industry standards, security measures, and cost-effectiveness are critical criteria. The ideal vendor should offer a flexible solution that seamlessly integrates with your existing systems, adheres to stringent security standards, and supports your growth ambitions without becoming a financial burden.

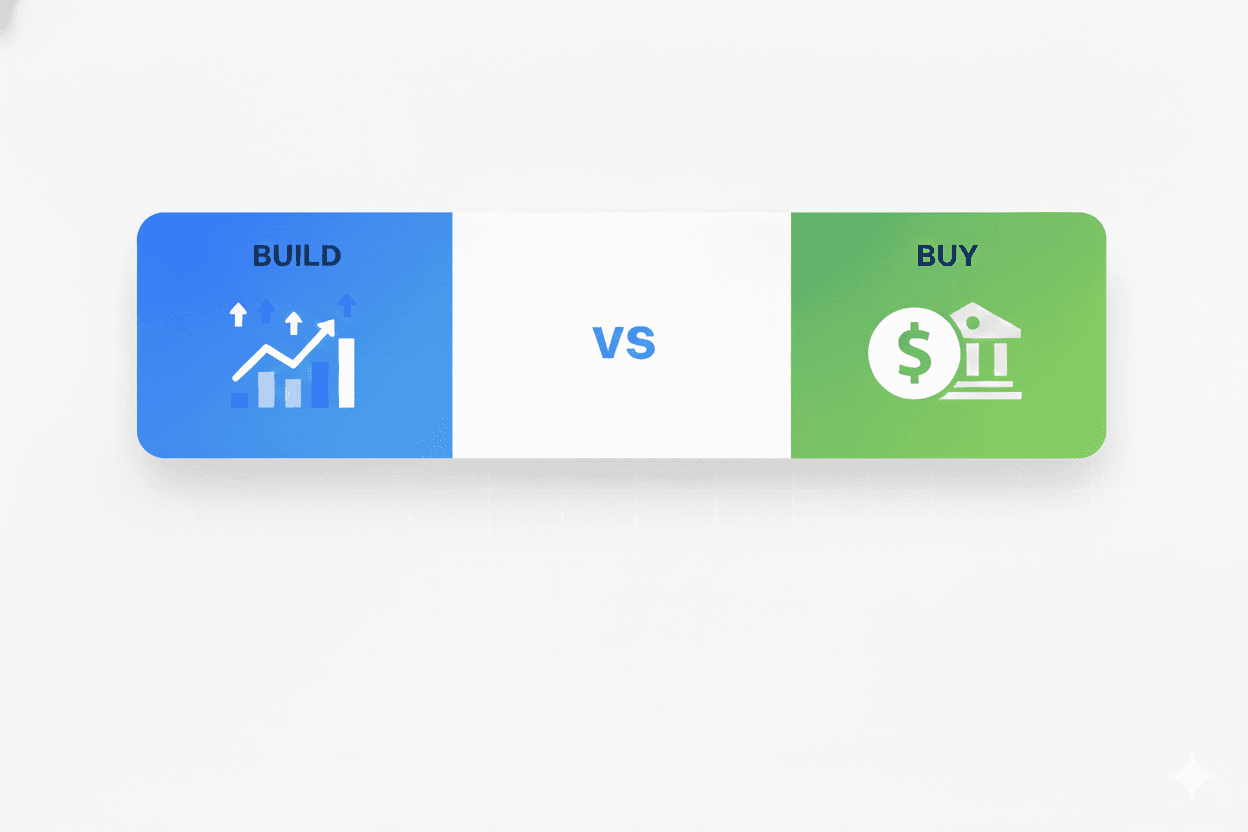

Brokerage vs. Balance Sheet Models

Once the technology foundation is in place, the next strategic decision revolves around the economic model that will underpin your lending program. The choice between a brokerage model and operating from your balance sheet involves weighing trade-offs related to control, risk, and profitability.

The Brokerage Model

The brokerage or marketplace model is a lighter approach to embedding financing into your platform. It involves integrating with one or more lenders to generate lead volume for external companies. While this model allows for rapid experimentation and lower risk exposure, it also means sharing a portion of the financing revenue and potentially sacrificing some control over the customer experience.

The Balance Sheet Approach

Taking the balance sheet approach means funding loans with your own capital or through a warehouse debt facility. This model offers greater control over credit decisions, underwriting, and the customer experience. It requires a more substantial initial investment and entails higher risk, but it can also lead to more favorable economics, such as higher net interest margins and gross margins.

The decision should consider your platform’s ability to control costs, manage risk, and efficiently price products. An understanding of your target market, competitive landscape, and regulatory environment is essential for making an informed choice.

Navigating Complexity with Ease

At Canopy, we understand the complexities of commercial lending and the challenges businesses face when choosing technology partners and economic models. Our suite of loan servicing software is designed to simplify these decisions, offering flexibility, integration capabilities, and compliance assurance.

Our technology solutions provide the foundation for both brokerage and balance sheet models, enabling you to select the best approach for your business needs. With Canopy, you can expect:

- Customization and Integration: Our platform is built to adapt to your specific requirements, ensuring a seamless integration into your existing workflows.

- Scalability and Security: Designed to grow with your business, our solutions meet the highest standards of security and compliance, protecting your and your customers’ interests.

- Expert Support: Our team of experts is committed to helping you navigate the technology and economic models of commercial lending, ensuring you make the best decisions for your business.

In the dynamic world of commercial lending, staying ahead requires a strategic approach to technology and economic models. By partnering with Canopy, you gain not just a technology vendor but a strategic ally committed to your success.

Have questions for the Canopy team about standing up or optimizing your commercial lending products? Want to be the first to receive our upcoming white paper that takes a deeper dive into setting up a commercial lending program?

Get in touch: Contact the Canopy team