Lending is a risky business, which is why underwriters spend so much time gathering and reviewing documents and why large loans can take months to close. However, technology can speed up the risk management process in lending and unlock even more opportunities for reducing risk before and after loan origination.

This article is a guide on credit risk management for small-to-medium-sized business (SMB) lenders. In it, we’ll cover:

- What credit risk management is.

- Practices lenders can use both before and after loan origination to reduce risks.

- How credit risk management platforms help lenders keep their portfolios healthy.

- How intelligent loan servicing helps reduce risks while creating opportunities for lenders to grow their business.

What is credit risk management?

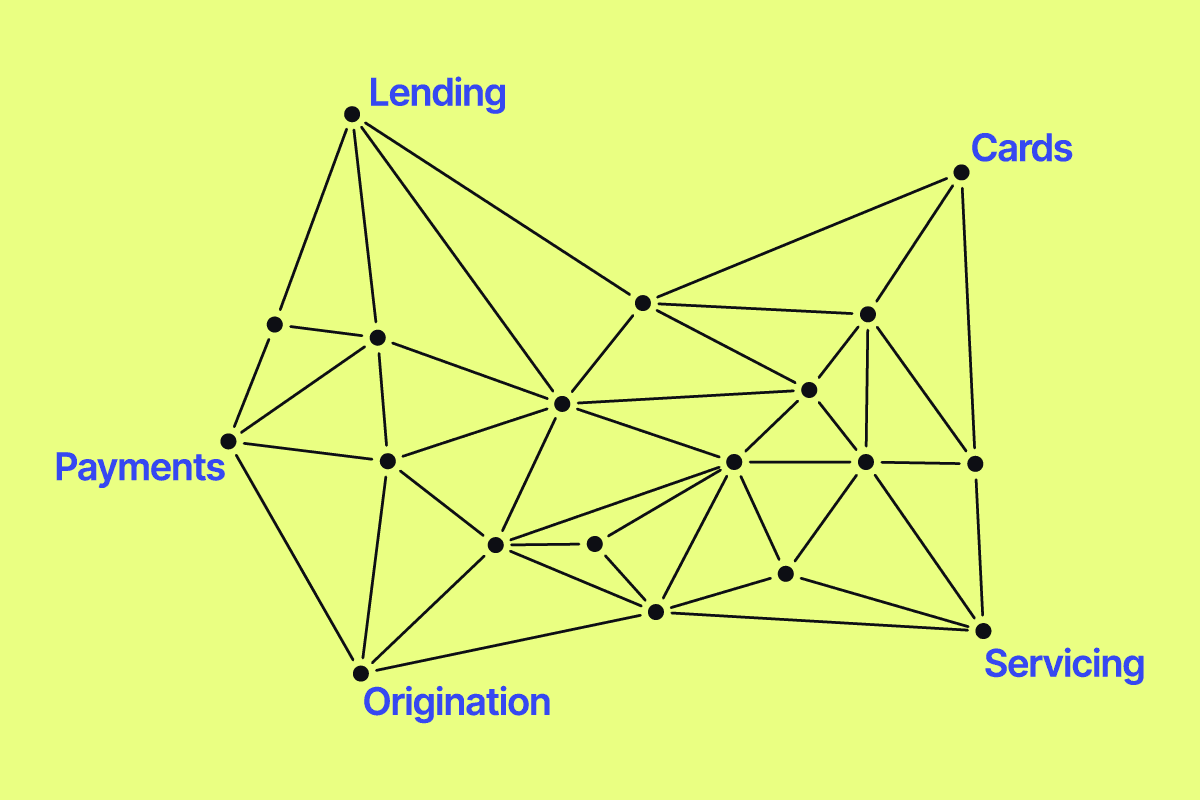

Credit risk management is a practice where lenders protect themselves from the risk of potential and existing borrowers failing to repay their loans. It can be done before and after loan origination, improving long-term profitability and ensuring a healthy loan portfolio.

Evaluating borrower risk by reviewing credit reports, cash flow data, debt-to-income ratios, and other metrics during the underwriting process is what most people think of when it comes to credit risk management. However, using tools to report, investigate, and remediate risks within your existing loan portfolio can significantly reduce risks. This is especially true for business lenders who focus on specific industries or verticals because they face industry-wide risks that could affect all of their customers in one blow, which could damage their business.

What practices should SMB lenders use in their credit risk management process?

Commercial credit risk management can help SMB lenders protect their loan portfolios for both new and existing loans. Here’s how they can protect themselves before a new loan origination and through ongoing management of their loan portfolio.

Credit risk management before loan origination

You can reduce your risk before offering a new loan by following these best practices:

- Thorough borrower assessment: Analyzing the business’s financial statements, debt-to-income ratio, collateral, credit reports, and the economic viability of the industry.

- Document verification: Verify that all documentation submitted to you is authentic and not altered in any way.

- Risk scoring/modeling: Use a standardized risk scoring model to assess a business’s creditworthiness based on historical data. You can potentially give better rates to companies that have lower risk scores.

- Flexible, risk-based loan configuration: Design loan products with the correct credit limits for each business’s risk profile, which can help reduce defaults and increase retention. If these loan products can be flexible and change with updated risk profiles over time, you can quickly expand your portfolio from your existing clients.

- Monitor underwriting performance: Track the performance of your past underwriting decisions to find any room for improvement. This includes improving your credit risk models as assessment methods as you uncover more performance data from your loan portfolio.

Ongoing credit risk management (i.e., loan portfolio management)

For your existing loan portfolio, the following best practices can help you reduce losses even after you’ve handed out a loan.

- Portfolio analysis: Regularly assess your portfolio’s performance and check risk for risk indicators such as missed payments and decreased originations.

- Industry analysis: Stay current on economic trends in your industry and identify potential impacts on the businesses in your portfolio and their ability to repay loans.

- Early warning risk indicators: Create and track KPIs for your overall portfolio for red flag metrics like late payment and credit utilization.

- Portfolio segmentation and risk ratings: Create a risk rating system for your portfolio customers and put high-risk accounts in their own segment. These are the customers you can take action on to help stop them from defaulting.

- Flexible loan modifications: Offer to restructure loans to a longer term, lower rate, temporary pause, and smaller payment for customers who are temporarily struggling to pay back loans.

Essentially, ongoing credit risk management involves identifying industry-wide and specific customer risks and adjusting to help customers facing temporary financial shortcomings. Canopy customers who offer flexible modifications for risk-adjusted loans see an average repayment increase of 30%.

Check out our article on loan portfolio risk management for more on this topic.

How credit risk management software best serves SMB lenders

Small business lenders can use software to help manage credit risk before and after loan origination. Credit risk management software solutions streamline the process of gathering data for underwriting and portfolio management—and analyzing that data to make those processes more efficient and profitable.

Here’s how a credit risk management system can help analyze new customers before origination and limit risk in your existing loan portfolio.

- Automated due diligence: As an integrated platform, Canopy can help set up custom automations using data from Canopy and partner systems to streamline your due diligence process. This automated workflow can reduce risk by ensuring that all new customers meet your standards for onboarding without requiring them to go through a lengthy manual process that could cause some customers to drop off.

- Data aggregation: A big part of managing credit risk is accessing the data sources you need. Canopy’s partner platforms, such as LendFlow and Bloom Credit, enable lenders to create an API connection that captures business data such as bank statements, cash flow data, credit reports, and other data needed to make a smart, data-driven decision for every loan.

- Credit risk scorecards: Now that you have that data faster, credit risk software can help you use it to create a risk score for each applicant. Scores can be automatically generated using templates that consider and weigh all data points based on what matters most to you.

- Credit-decision engines: You can go a step further and integrate automated credit decisioning software into your underwriting process. In this case, the software will automatically generate loan terms based on the credit risk score and other determining factors. This can help you scale your loan business, especially for smaller-risk or low-dollar loans that don’t necessarily need a human underwriter to approve.

- Risk-based configurations: Software can also help you offer loan products with credit limits that make sense for each business you lend to based on their risk profile and scorecard. Offering the right products can help reduce defaults and retain more customers for longer.

- Portfolio monitoring: Loan servicing platforms like Canopy aggregate your loan portfolio data under one system, unlocking insights that can help you reduce risk. These include the number of late payments, defaults, credit utilization rates, and other indicators that show signs of struggle across the industries you loan to.

- Intelligent loan servicing: Using Canopy, lenders can flexibly adapt their loan products based on a customer’s financial situation today rather than when they took out the loan. This means that interest rates and repayment periods can be adjusted to help customers make payments during hard times, or you can offer more capital to customers who are doing well. Either way, it reduces risk and adds long-term profitability to your portfolio.

Improve your credit portfolio’s performance

Credit risk management isn’t just about reducing default rates; it can also help you improve your credit portfolio’s performance, increase its size, and strengthen borrower relationships (which is especially important for small business lenders).

Canopy is a loan management system that can help you reduce risk, improve your portfolio health, and cut time to market.

LoanLab enables you to test different loan policies and actions to see how they will play out over time. Meanwhile, DataDirect helps you analyze borrower activity for your portfolio and specific customer accounts.

Ready to build an integrated credit risk management software program for your lending business? Contact our team to learn how we can help you achieve more while reducing risk.