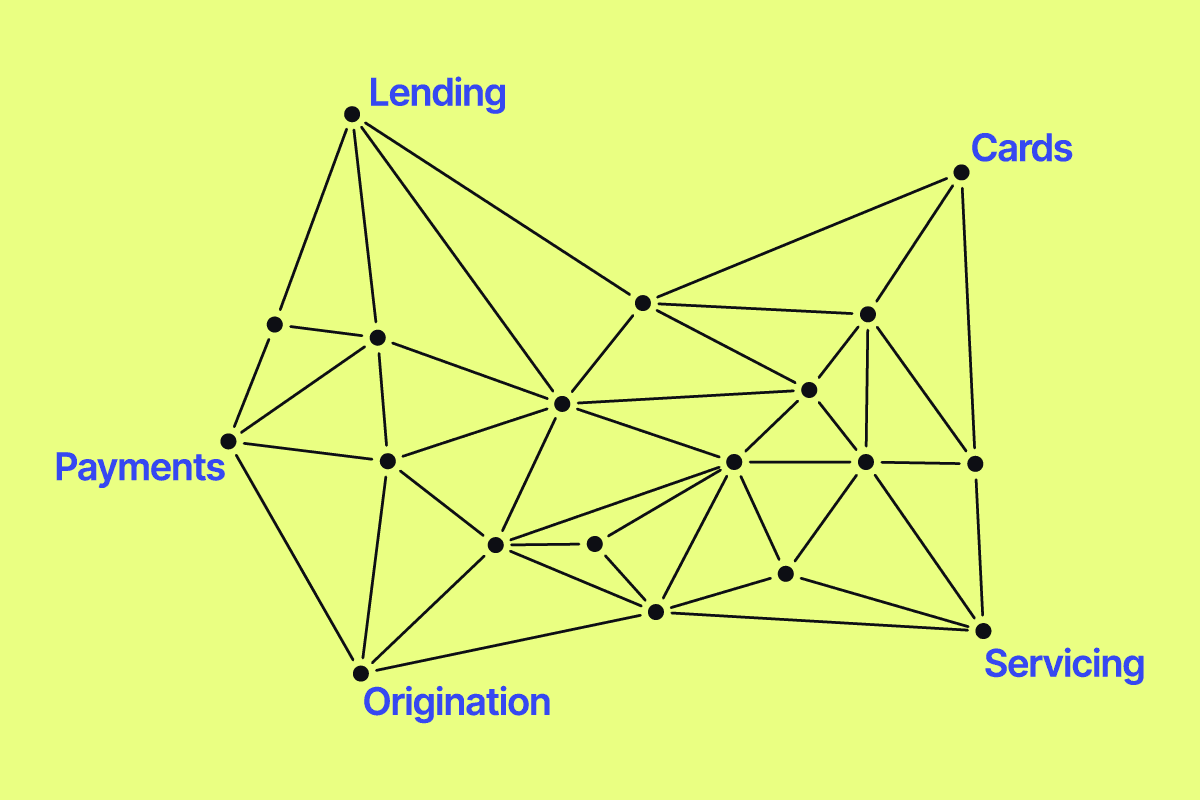

Commercial lending is a competitive space, and the origination and underwriting processes are the backbone of a successful lending program. A well-structured origination strategy not only identifies and engages potential borrowers, but sets the stage for a positive lending experience. Meanwhile, a sophisticated underwriting approach balances risk management with the goal of expanding your lending portfolio. This blog explores effective strategies for optimizing these critical stages of your commercial lending program.

Streamlining Origination for Maximum Impact

Let’s start with origination – the process of creating and promoting your lending products to the right audience at the right time. Success in origination hinges on integrating loan products into the natural workflow of your users. This helps ensure your products both reach and resonate with potential borrowers.

Identifying entry points within the user journey where financial needs arise is crucial. For instance, a B2B e-commerce platform might introduce working capital options at the point of purchase, addressing a common pain point of liquidity for small business purchasers.

Using data analytics to understand your customers’ behavior and needs can significantly enhance targeting and personalization. By analyzing platform data, you can identify potential borrowers with a high likelihood of approval and tailor your outreach accordingly. This targeted approach not only improves customer engagement but also increases the efficiency of your origination efforts.

Technological advancements play a pivotal role in streamlining the origination process. Automated systems can facilitate direct integration of financial offerings into existing user workflows, making the discovery of lending products seamless and intuitive. Additionally, AI and machine learning can help predict customer needs, offering financial solutions proactively.

Refining Underwriting to Balance Quality and Quantity

Underwriting is where the rubber meets the road in commercial lending. It’s the process that determines which businesses receive financing and under what terms. Balancing the expansion of your lending portfolio with maintaining low risk levels is an art form that requires a nuanced approach.

One size does not fit all in underwriting. Customizing your underwriting criteria based on industry-specific risks and borrower profiles can significantly improve decision-making. This customization might involve developing proprietary risk models that leverage both financial and non-financial data, providing a holistic view of each applicant’s creditworthiness.

Modern underwriting relies heavily on technology to manage risk effectively. Automated tools can process large volumes of applications quickly, applying consistent criteria to each. Meanwhile, advanced analytics and AI models can identify patterns and risks that might not be apparent from traditional financial metrics alone.

The underwriting process should not be static. Continuous feedback loops, incorporating insights from loan performance and market trends, are essential for refining your underwriting criteria. This iterative process ensures your lending program remains responsive to changing market conditions and borrower behaviors.

Enhancing Origination and Underwriting with Sophistication

At Canopy, we recognize the complexities inherent in the origination and underwriting processes of commercial lending. Our platform is designed to address these challenges head-on, providing lenders with the tools they need to streamline origination and refine underwriting.

For Origination

Canopy’s solutions facilitate the seamless integration of financial products into user workflows, enhancing discovery and engagement. Our data analytics capabilities enable lenders to target potential borrowers effectively, improving the efficiency and success rate of origination efforts.

For Underwriting

We offer sophisticated risk management tools that allow for the customization of underwriting criteria, leveraging both traditional and alternative data sources. Our platform supports continuous improvement, with analytics and reporting features that feed real-time insights back into the underwriting process.

Success hinges on your ability to effectively originate and underwrite loans. By leveraging the right strategies and technologies, you can not only expand your lending portfolio but also manage risk effectively, ensuring the long-term success of your program.

Have questions for the Canopy team about standing up or optimizing your commercial lending products?

Get in touch: Contact the Canopy team