Table of contents:

- What are loan portfolio risks?

- How can data improve loan risk management?

- How loan risk management software uses portfolio data to reduce risk

- Why embedded SaaS lenders especially need to manage risk

There are many uncontrollable risks that lenders are exposed to. The bigger the lender, the greater the risks. However, the data in your greater loan portfolio can help you mitigate those risks. If you have flexibility and adaptability in your existing loan terms, you can even turn those risks into a beneficial opportunity for yourself and your customers.

Below, we’ll explore loan portfolio risks, how portfolio data can help you manage them, and how you can create an intelligent servicing platform that helps you adapt and thrive through risks.

Why managing portfolio risk is important

When you own a sizeable portfolio of loans, managing risk from macro trends becomes more important than from a single individual or business. Uncontrollable risks will vary depending on the industries you lend to, but climate, politics, war, and the economy can affect your portfolio. Using data to proactively manage and respond to these risks is crucial.

For example, if you specialize in providing capital to ski resorts, you will be more at risk from climate variability. Two poor snow seasons could significantly increase the chances of mass defaults throughout your portfolio. Using your portfolio data, you could look for customers struggling through the poor snow seasons and offer to suspend a payment or readjust a loan. Or, you could protect yourself by not offering a working capital loan to a customer you expect might be struggling with forecasted climate volatility. There are many ways to manage risk.

Even with a more diverse portfolio, you can still use your data to manage risks from political and regulatory change and economic swings. There are always bubbles forming in the real estate and capital markets that can affect the companies in your portfolio and their ability to repay you. You can make flexible and adaptable changes to respond to or get ahead of those risks.

Managing portfolio risk is especially important in commercial lending because loans are high value, businesses will take out multiple loans from the same provider, and ongoing relationships form.

To help manage these risks, your portfolio contains the most valuable data.

How can data improve loan risk management?

Lenders who have access to performance data from their loan portfolio can use that data to assess potential risk factors. Examining data points across an entire loan portfolio, like total missed payments by date ranges and origination numbers over time, can show how your portfolio responds to market events.

With the data from your loan portfolio, you can see what state your customers are in based on what’s happening worldwide, either from a repayment or new loan creation perspective. With that information, you can plan how you, as a lender, will react.

Example: Farm industry loans

Imagine you’re a farm equipment or even farm SaaS provider, and you offer your customers working capital loans to cover expenses or grow their business. Let’s say this Summer is expected to be much hotter than usual, and yields may be down. Not only can you watch how your portfolio reacts regarding origination and defaults, but you can also offer a helping hand.

You could temporarily suspend repayments, reduce interest rates, or offer a complete loan restructuring to minimize delinquencies. In the long term, your business will be much healthier with more customers getting through the hot Summer without going out of business, so anything you can do to reduce their risk will keep you healthier.

This is just one example of how loan portfolio risk management can help. You could also offer incentives, such as 0% interest for one year, to increase originations during expected boom times and grow your portfolio.

Recommended strategies to reduce risk

How can loan risk management software help?

As part of our loan servicing suite, Canopy offers loan risk management tools based on your loan portfolio data. It aggregates your servicing data and combines it with business intelligence data from outside systems to create an “intelligent servicing” system.

With intelligent servicing, you can identify which borrowers are likely healthy and unhealthy. You can surface rewards for healthy borrowers to incentivize growing their business and increase origination opportunities. For unhealthy borrowers, you can intervene before a payment is missed to reduce the risk of delinquency and default.

If you’ve identified a cohort likely to underperform due to macro risk factors, you can proactively offer to shift due dates, reduce interest rates, or restructure loans entirely. For example, you could offer all companies in the cohort with a 5-year loan at 10% interest the opportunity to restructure it into a 10-year loan at 8% interest to help them get through collective hard times.

For companies that offer loans in a specific vertical industry, like in our farm example above, this provides a way to deepen customer relationships and contribute to the health of an entire industry. The goal is to help your customers’ businesses so you can also preserve your own.

Outcomes of Intelligent Servicing for portfolio risk management

Loan portfolio risk management is essential for embedded SaaS lenders

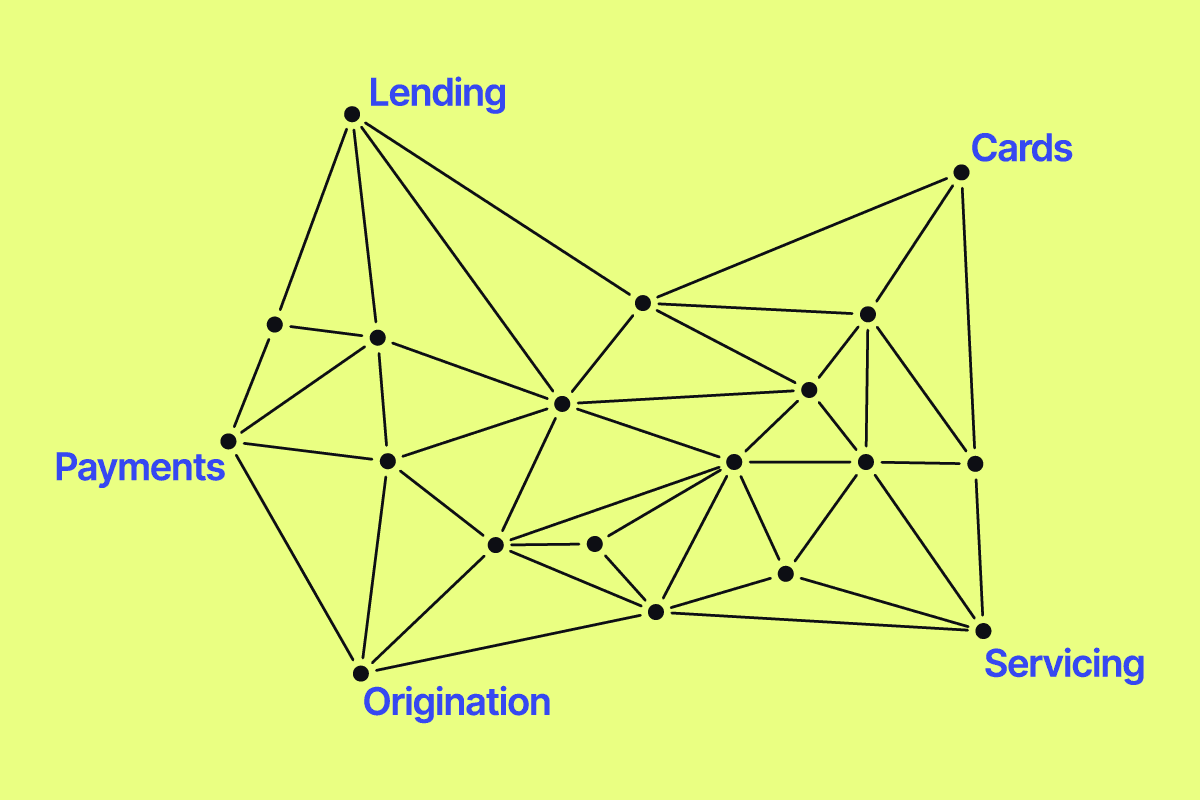

Embedded lending from non-financial SaaS companies is one of the fastest-growing areas in lending, with an expected market size of over $23B by 2031. Because they are deeply entrenched in specific market segments, SaaS companies are in a great position to offer lending to help their customers cover costs and grow their business.

Embedded Lending Market Size

At the same time, these lenders also lend to specific industries or types of businesses and could be at higher exposure to risks from market forces, changing regulations, weather, or other uncontrollable events. Therefore, embedded SaaS lenders need to manage risks within their loan portfolios.

Toast Capital, for example, offers working capital loans to restaurants to help cover costs in an industry known for thin profit margins. With deep insights and data into the restaurant industry, there are many ways a SaaS lender like Toast could use loan portfolio risk management to both help customers stay afloat and preserve their long-term profitability.

Perhaps a recession keeps people eating at home or scares over another pandemic reduce industry sales by 25% during flu season. Using a platform like Canopy, a restaurant lender like Toast can monitor how these trends affect customers and offer adjustments to help them stay afloat.

During hard times, loan profitability becomes a second-order problem, and keeping businesses afloat becomes more critical. Adaptability in loan terms and structure can help solidify relationships between businesses and lenders while maintaining the health of both.

Unlock risk management using your current loan portfolio data

Your loan portfolio contains rich, valuable data that can help you better manage uncontrollable macro risks and ensure the health of your customers and industry during hard times. You can achieve this while preserving long-term loan profitability and strengthening customer relationships—which only increases originations as your customers grow during good times.

Contact our team to learn how to start better managing your loan portfolio risks.