Modern lending is a complicated process, with many different systems involved. Important processes like the application and underwriting take place before the loan is granted, but the majority of the loan’s lifetime occurs after that, during loan servicing.

Modern loan servicing software gives lenders a competitive edge over those stuck using archaic systems or spreadsheets. They serve as an integrated system of record where you can view and assess all of the data for your loan portfolio. This alone can drive massive efficiency and productivity gains.

In this article, we’ll discuss:

- What loan servicing software is and what features a modern system should have

- The problems with manual or spreadsheet-based loan servicing

- The increased profitability and other benefits that loan servicing software provides

- Why it’s essential to have an integrated system of record for all lending activities

The drawbacks of manual or spreadsheet-based loan servicing

Loan servicing includes an endless bevy of tasks. These include sending monthly statements, collecting payments, maintaining records, managing escrow funds, and following up on late payments and delinquencies. Yet, many lenders track their accounts through a spreadsheet and use disparate systems for things like payments and reminders. This creates a ‘manual’ system for servicing the loan, where different systems exist in siloes that don’t integrate.

This leads to several common drawbacks:

- Time-consuming tasks: Using spreadsheets leads to repetitive tasks that take too much employee time. These include tracking delinquencies, calculating or recalculating payments, sending statements, and creating reports.

- Human error: Spreadsheets don’t double-check for mistakes. It’s easy to end up with data entry errors, overlooked missed payments, or other miscalculations.

- Limited scalability: As portfolios grow, so do spreadsheets. Eventually, they become unmanageable. This creates inefficiencies that can only be corrected by implementing a modern system.

Poor loan servicing practices create a competitive disadvantage

Servicing loans in this limited way creates problems for lenders, especially those in competitive environments. According to Canopy’s recent market research, we identified four of the biggest pain points SMB lenders face in servicing loans.

- Fierce competition and a need to differentiate to win.

- Challenges in tailoring and adapting financial products to borrowers.

- Managing operations, compliance, and financial reporting.

- Proactively identifying risks and learning over time.

With manual servicing, lenders aren’t getting the data and functionality they need to adapt to these challenges. They end up stuck with slow processes and siloed systems that cause them to fall behind the competition. That’s why loan servicing software becomes crucial.

Modern loan servicing software features

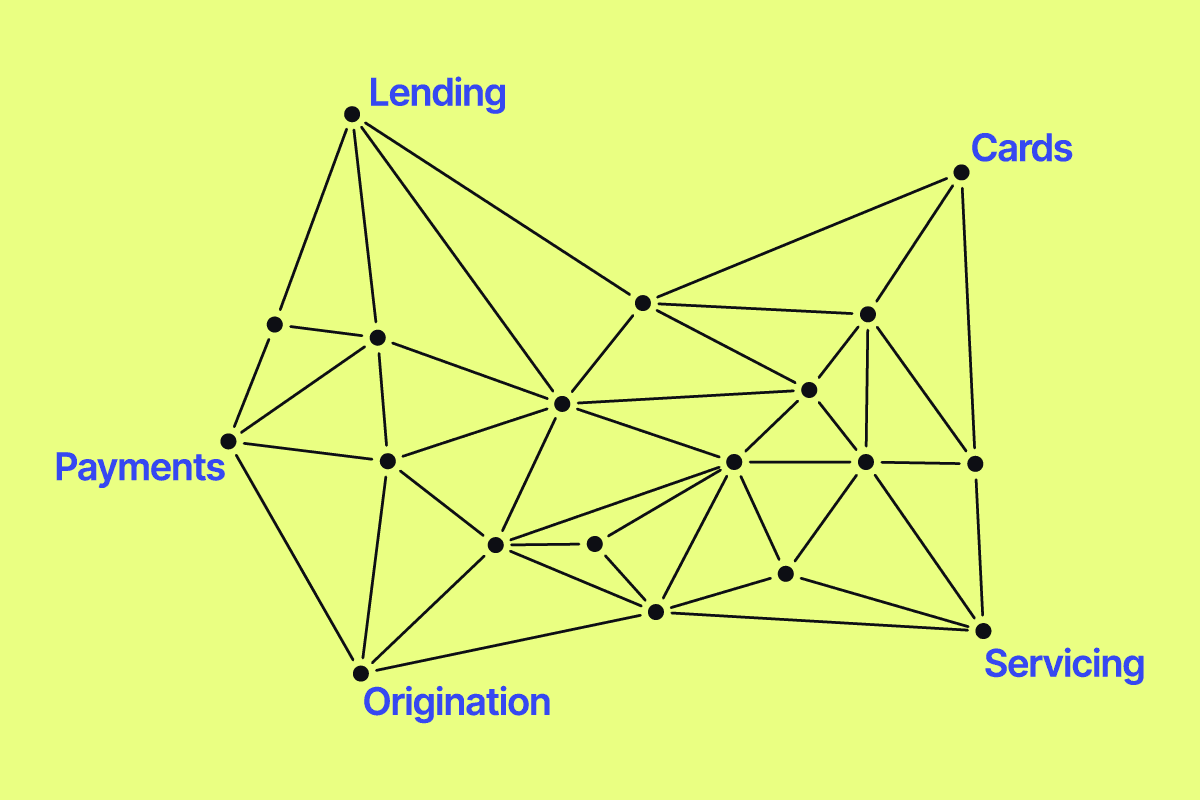

Loan servicing software replaces the spreadsheet, taking over tasks like recording payments, sending statements, and tracking delinquencies. It’s not a rip and replace of the spreadsheet – instead, it serves as a complete loan servicing system. It should also seamlessly integrate with your payments, accounting, origination, and other systems. Integration allows you to use it as a system of record for tracking and servicing your entire portfolio.

The core features of a loan servicing system include document management, reporting, payment tracking, account status tracking, and other basic functionality. However, a modern system should have the following capabilities:

- An integrated system of record: Loan servicing software should integrate with each piece of your lending program and be where you go to see all your lending data. All records, including origination, payments, accounting, and even customer service, should be visible.

- Automated workflows: You should be able to connect your integrated lending systems and processes to create automated workflows. For example, if a payment is shown to be missed in your payments system, an automated reminder should be sent from your customer service platform. The integrated loan servicing software can facilitate this.

- Flexible servicing: You should be able to easily update any loan’s interest rates and payment lengths at any time. If a customer is temporarily struggling, you’re better off giving them some flexibility. Temporarily suspending payments or restructuring a loan for lower monthly payments can help you keep a long-term customer rather than lose one. Loan servicing software can make this process which was once tricky, relatively easy.

- Advanced portfolio reporting and analytics: You should be able to create reports for each account and on the health of your portfolio as a whole. You should also be able to drill down into different customer segments. This can help you identify risks within certain industries that you can proactively mitigate by offering flexible terms.

- Policy and product testing: Modern servicing systems allow you to simulate the lifecycle of a loan. This includes testing policies and actions and observing how they would play out over time. This can help you choose the most profitable and effective products and policies for your customers.

The benefits of switching to loan servicing software

Using software for loan servicing offers many benefits compared to using systems not specifically designed for servicing loans. The ultimate benefit is increased revenue and decreased losses through efficient and effective servicing. Below are the specific benefits that lead up to that.

Intelligent servicing

Above, we mentioned ‘flexible servicing’ as a premium capability of loan servicing software. When using a basic system for loan servicing, you can’t adjust rates or create payment pauses. If a customer becomes delinquent, they don’t get a chance to save the loan before it goes to collections.

With flexible or ‘intelligent’ servicing, you can identify at-risk customers and preemptively offer flexible terms or payment periods to help them avoid delinquency. Even if there are a few missed payments here and there, fewer delinquent customers are better.

Healthier portfolios

An automated system for collecting payments, sending reminders, and mitigating at-risk customers leads to a healthier portfolio. Your loan program will create more profits over a longer period, and you will have more healthy customers.

Higher repayment rates

With the automated system for payment reminders and flexible repayment terms for at-risk customers, you will have higher repayment rates. Canopy customers who implement flexible loan servicing see, on average, a 30% higher repayment rate than when they used non-flexible terms.

Enhanced portfolio risk management

An integrated loan servicing platform means that all your portfolio data is in one place (a system of record) and can easily be analyzed and used for risk assessment. You can monitor individual accounts for red flags and watch customer segments to see if certain types of businesses are affected by uncontrollable factors like weather or the economy. You can also assess your entire portfolio to uncover risks and develop new strategies.

Increased efficiency and scalability

Lastly, using a single integrated system for servicing your portfolio is efficient, scalable, and effective. You’ll be able to confidently add many new customers to your portfolio without being concerned that your staff or spreadsheet-based system can’t handle the workload. With automated workflows, there are fewer human errors and reduced operational costs as your staff can focus on real problems and less repetitive work.

Loan servicing software is the integrated backbone of your lending program

In lending, no single software system does it all. You will have separate systems for accounting, payments, origination, and more. To be effective, loan servicing software needs to combine all of those elements into one system where you can manage all your active loans. It becomes the core system of your loan program, where you can log in to find and do anything you need related to your customers or portfolio.

Canopy is a commercial loan servicing software system that acts as the operating system for your entire loan portfolio. From it, you can connect all of your lending-related systems, service all of your loans, test and launch new products, manage and finetune customer accounts, and ensure transparency and compliance. It’s a fully integrated hub of your lending program that enables you to maximize your cash flow and easily scale.