In the latest edition of our LinkedIn newsletter, The Lending Innovator by Canopy Founder & CEO Matt Bivons, we looked at how real-time data becomes even more important in a rising delinquency environment.

The credit market is something we’re all talking about a lot these days. The average consumer has remained extremely resilient in the face of inflation and higher interest rates. And while some data is still pointing towards a recession, other economic figures predict more of a soft landing. Even some of the most well known economists are confused at what might come next.

Nevertheless, credit card delinquencies are rising, and while economists are mixed on whether we’ll have a recession and how severe it might be, financial institutions and lenders are keeping a close eye on the credit market.

Caution from Big Banks

While delinquencies are ticking up, consumer confidence is also rising. This creates a predicament for fintechs and banks alike to strike the right balance in serving their customers. So what are the big banks, who see loads of consumer data, saying?

Last week several of the largest US banks, including Wells Fargo, JPMorgan, and Citigroup, reported on their earnings. Here’s a glimpse at what they’re telling investors.

Wells Fargo CEO, Charlie Scharf:

“The U.S. economy continues to perform better than many had expected, and although there will likely be continued economic slowing and uncertainty remains, it is quite possible the range of scenarios will narrow over the next few quarters.”

JPMorgan CEO, Jamie Dimon:

“The U.S. economy continues to be resilient,” but he also added that consumers are “slowly using up their cash buffers.”

Citigroup CEO, Jane Fraser:

“I’d say we’re seeing a more cautious consumer, but not necessarily a recessionary one.”

Why Batch Data Will No Longer Cut it

In an environment of continued economic uncertainty, how can lenders be proactive in servicing their customers and being empathetic toward the challenges yet to come?

After all, fintech companies can’t suddenly raise wages or lower inflation and the unemployment rate, but it can help lenders and their customers stay on top of payments and make necessary changes. A big way they can do that is by providing real-time data and flexibility to those who need it.

The Problem with Enterprise Processors

Traditional processors, while reliable, still provide data in batches.

If your system isn’t looking at real-time data, you’re at risk of higher defaults since you have lower visibility into who has missed their first payment. In the credit world, time can have a huge impact. By surfacing loan data in a straightforward portal for team members and borrowers, operators are in a much better position to make smarter decisions that meet their customers where they are.

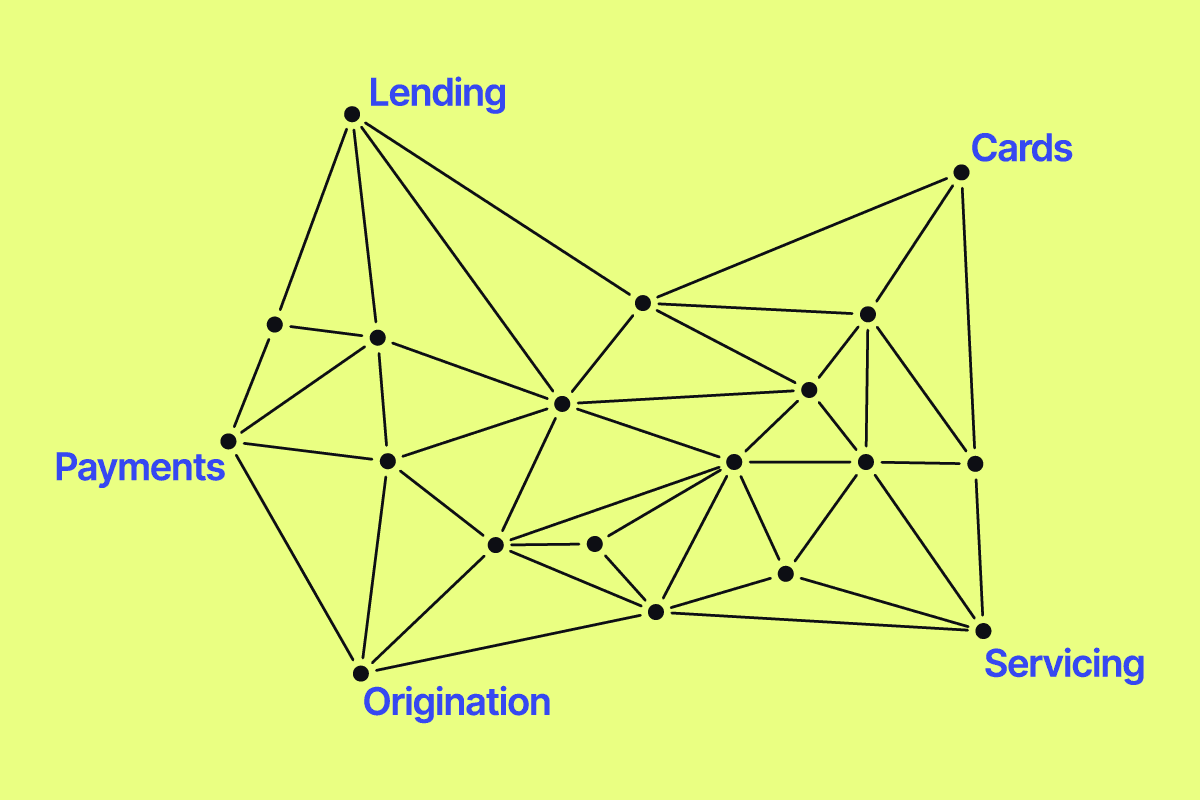

With a modern processor, lenders can use a flexible lending core to recoup their payments, lower delinquency rates through automation and communication, iterate to understand what’s going on with their customers in real-time, and help service reps answer simple questions.

There’s no doubt this level of automation and servicing is going to be critical when the cycle turns.

See full take on this topic and follow along with the latest industry trends by subscribing to our exclusive LinkedIn Newsletter, The Lending Innovator.