Evaluating a potential borrower for a loan is a complex process with many variables.

Yet, for many loans (business loans in particular), lenders’ interest rates don’t vary—even when one customer is much less risky than another. This may be a major missed opportunity, or one for a competitive advantage if played right.

Lenders can offer dynamic pricing that sets them up for long-term success by factoring risk into the underwriting process and loan terms.

With risk-based pricing, you can hedge risks by offering higher interest rates to risky borrowers and gain more low-risk customers by offering better terms.

In this article, we’ll help you understand:

- What is risk-based pricing, and how does it vary from traditional underwriting

- The criteria lenders use for risk-based pricing

- The benefits of risk-based pricing

- How B2B lenders can start offering risk-based pricing

What is risk-based pricing?

Risk-based pricing is a strategy that lenders use to determine loan terms based on various borrower risks. If borrowers have a higher perceived risk of defaulting, they will be offered higher interest rates or shorter repayment terms. They will be offered lower rates and more favorable terms if they have less perceived risk.

Risk-based pricing vs traditional underwriting

While making loan decisions based on borrower risk sounds similar to traditional underwriting processes, risk-based pricing isn’t the same thing. Traditional underwriting relies more on human judgment and qualitative assessments, using fixed criteria like credit scores to determine rates and terms with limited flexibility.

Risk-based underwriting takes a quantitative approach. It relies more on mathematical formulas and data analysis to thoroughly assess risk. It has more dynamic criteria that can change based on market conditions and analyzes risk factors. It also offers companies more flexibility to offer better loan terms or to protect themselves against risk better.

Risk-based pricing criteria

Beyond the traditional underwriting criteria, such as credit score, credit history, and debt-to-income ratios, risk-based pricing also uses other factors to set a loan’s terms.

These include:

- Loan type and amount

- Economic conditions that might affect the ability to repay

- The type and nature of the business (if it’s a business loan)

- Risk scores created by plugging borrower data into pre-determined formulas

- Pricing algorithms that consider a wide range of factors and can shift interest rates based on various conditions

- Judgment from expert underwriters who assess the available data and risks

Considering these extra factors and analyzing the data more deeply creates many benefits for the lender, whether it’s a business or consumer loan.

Risk-based pricing benefits

Embracing risk-based pricing helps lenders create stronger revenue streams and build healthier long-term portfolios in the following ways:

Optimized profit margins

By aligning loan pricing with borrower risk, lenders ensure higher returns on riskier loans while remaining competitive for lower-risk clients.

Enhanced risk management

Adjusting rates and fees according to risk helps mitigate potential losses and maintain a healthier loan portfolio.

Attracting quality clients

More competitive rates for low-risk borrowers can attract more business from reputable companies and borrowers, fostering healthy long-term relationships.

Staying competitive

Informed pricing strategies set lenders apart from competitors that still use one-size-fits-all rates, especially for low-risk customers.

Smarter risk assessments

Risk is not a binary ‘yes’ or ‘no’ approval assessment, and loan terms shouldn’t be either. Using more data and better algorithms helps lenders determine ‘smarter’ terms that help their business and customers long term.

More flexibility and innovation

Using more data and smarter assessments can enable lenders to develop innovative new lending products that better cater to their borrowers. More flexible loan terms and different types of loan products become possible.

Is a risk-based pricing notice required?

The Consumer Financial Protection Bureau (CFPB) requires a risk-based pricing notice for consumer loans that meet certain conditions, such as varying interest rates based on a consumer’s risk.

However, a notice is not required for business loans. It’s generally only needed for credit cards, mortgages, auto, or personal loans. A notice isn’t required in business lending, even if a personal credit score is used in the evaluation.

Risk-based pricing for business loans

While risk-based pricing is more common in business-to-consumer loans, it’s not as widespread in business-to-business lending. At Canopy, we believe that should change.

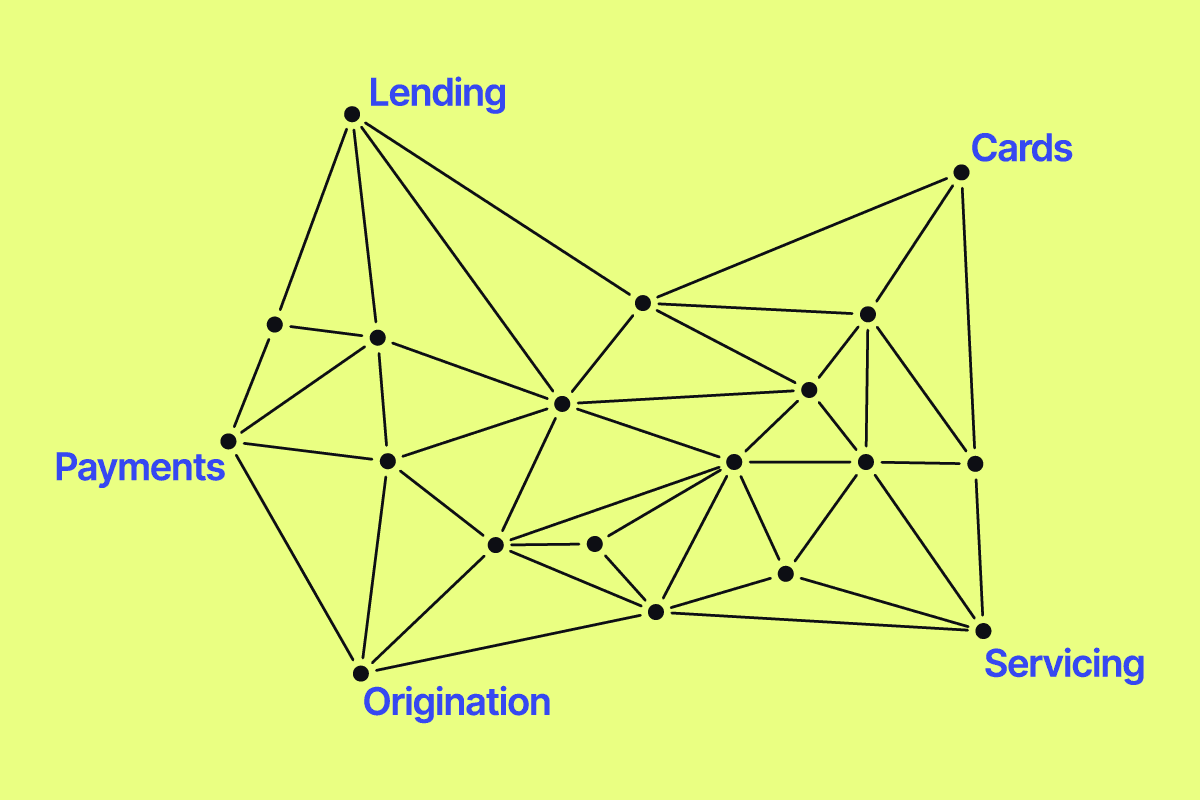

The nature of business lending is changing, with more non-financial companies becoming embedded lenders and offering more flexible types of loans. These lenders, often software companies, are closer to their customers and more willing to try new things than traditional banks. Many already offer more flexible and innovative loans, such as working capital loans and B2B buy now pay later (B2B BNPL) loans.

It’s a natural transition for embedded lenders and SaaS companies offering loans to adopt risk-based pricing to increase their ability to offer competitive products. Adopting this strategy in an area where traditional banks aren’t doing so can create an even more significant competitive advantage for business loans.

Adopt risk-based pricing for business loans with Canopy

Canopy is a lending platform that helps B2B lenders, often in embedded lending and fintech, create an integrated lending program for everything from origination to loan servicing.

We firmly believe more B2B lenders should leverage risk-based pricing strategies to optimize their loan portfolios and increase profitability. Our features help lenders achieve just that.

When setting up new loan products, Canopy allows for default values in the loan policy’s attributes, but it also enables you to customize your loan model’s interest and fee structure. You can also set up automated policy customization based on your credit risk models and streamline pricing adjustments.

Your program will start with default terms which you can adjust based on risk level, a risk-based pricing model in action. To see how your risk-based pricing loans are performing over time, you can easily run reports on loan performance by different credit model cohorts.

Test your risk-based loan pricing model before going live

Canopy’s LoanLab lets you run simulations to preview potential outcomes based on various risk scenarios. This helps you test your new policy configurations before you go live with a loan product, so your team understands how risk-based pricing strategies will affect your portfolio.