Many small businesses are getting left behind in traditional financing, often having to wait months to access the capital they need or get outright rejected by banks. In fact, according to a 2024 Small Business Credit Survey, only 14.6% of small business loans get approved by big banks.

This gap opens the door for non-financial companies to become lenders for small businesses, also known as embedded lending. No company is better situated to become a lender to their customers than a SaaS company.

In this article, we’ll cover:

- What is SaaS lending, and why do SaaS providers make the ideal lender?

- The benefits that SaaS lenders and their customers enjoy

- The different types of SaaS lending

- Why flexibility is so vital in SaaS lending

- How to start your lending program

What is SaaS lending?

SaaS lending occurs when software companies offer lending products to new and existing customers. While it’s commonly used to finance software purchases, it has a variety of other uses.

These include working capital loans to help customers cover everyday expenses, buy now pay later (BNPL) loans to finance large equipment purchases, or lines of credit and installment loans to help customers expand.

Why SaaS companies are perfectly positioned to offer lending products

SaaS companies don’t play the role of a typical B2B vendor. Instead, they are entrenched in their customer’s operations as a key system that helps them run their business. For many SaaS products, their customers couldn’t run their business without them.

This uniquely positions them at the heart of their customer’s business. Because they are frequently in touch with customers and need to maintain a good working relationship to ensure they renew their subscriptions, SaaS companies can easily offer lending products to help their customers thrive and grow.

What benefits does SaaS-based lending provide?

Offering lending products to SaaS customers can improve both the SaaS company’s and the customer’s economic position. Below are some of the main benefits a SaaS lending platform can provide.

1. Increased affordability and customer satisfaction

Like auto and home sales, offering financing can increase how much your customers can afford for your SaaS products. This can also boost customer satisfaction, as financing gives them more flexibility in what they can do with their funds in other areas of the business.

2. More sales and higher revenue

Financing a SaaS product can drastically reduce your closed-won sales rate and the dollar amount of each sale, as customers can use financing to pay for top-tier packages. This leads to higher revenue from increased sales and the interest on the loans you provide. If you expand into areas like working capital loans or BNPL, you can further increase interest-based revenue.

3. Reduced churn

When a customer finances your product and has to repay a loan in installments, they’re more invested than just paying a monthly subscription cost. During the loan period, customers may be less willing to abandon ship due to the sunk cost of the loan they took out for your product.

4. New revenue streams

Many SaaS companies break into embedded lending because it offers an exciting new way to increase revenue that isn’t purely product-based. Companies across many industries are getting into financial products to grow their bottom line. The global embedded finance market is expected to grow to $251.5B by 2029, a 16% compound annual growth rate from its current value of $115.8B in 2024.

5. Stronger customer relationships and brand loyalty

Helping improve your customer’s financial situation and giving them more options further strengthens your relationship as a core part of their business. They already rely on you for a crucial business function through software, but now you’re also helping them expand their business, improve cash flow, and stay financially stable during tough economic times. This makes you all the more important to them and can increase long-term loyalty.

Types of SaaS lending

Embedded SaaS lending isn’t quite the same as going to a traditional bank to get a loan. It’s typically executed much faster and is more open to accepting small business customers. Here are the types of lending that Canopy’s SaaS customers usually offer.

Financing for software-related purchases

This is the first area where a SaaS company might look to offer lending products because it can directly increase sales by providing customers with financing options that fit their budget. There are typically upfront costs beyond the monthly subscription fee for SaaS products, such as implementation or hardware. Spreading out these costs over an extended period through financing can make it easier for businesses to stomach the software implementation.

Typically, these would be done through an installment loan, which can be flexible based on the business, the amount, and the SaaS company’s preferences.

Financing for equipment or other large purchases

Once you have an established relationship with a customer, you can offer other types of loans to help them achieve their goals. One area that’s becoming popular is BNPL for business-to-business (B2B) transactions. These simpler loans are typically paid back in four to six installments and are commonly used for large one-time purchases.

Working capital loans

By offering working capital loans, SaaS companies help their customers with funds to cover everyday expenses. These can be either a line of credit or a short-term loan with fixed terms. These are usually for somewhat smaller amounts but can be a lifeline to businesses in volatile or seasonal industries.

These fast and flexible loans help customers weather tough times. SaaS companies are also protecting their own long-term health because fewer of their customers will go out of business, further reducing churn.

Invoice factoring and cash advances

Many businesses get stuck waiting for cash to hit their accounts while bills are piling up. To help them pay their bills on time, SaaS companies can offer loans based on expected incoming deposits.

For companies that receive invoices, these loans are called ‘invoice factoring,’ which essentially means offering a loan based on an invoice that hasn’t yet been paid. Once the invoice is paid, the business pays back the loan plus interest.

For companies like retail, ecommerce, or restaurants, lenders can offer merchant cash advances that provide a lump sum loan in exchange for a percentage of credit card or other sales. Repayment happens automatically, so this is a low-hassle way for businesses to gain access to needed cash faster.

Line of credit

Some SaaS companies can offer lending products similar to a traditional bank, such as a line of credit. This is a simple revolving credit that customers can access at any time, repay at a set interest rate, and then repeat when needed until the limit is reached.

The importance of flexibility in SaaS lending

One of the main reasons that businesses turn to SaaS providers for loans is because they offer speed and flexibility that traditional banks can’t offer. Not only do they get access to funds faster, but they can also get more flexible repayment terms, which is key to long-term success.

At Canopy, we help SaaS companies set up flexible lending programs that keep borrowers happier. For example, if a SaaS lender serves an industry with up and down seasons, they can easily change the loan terms during the low seasons to offer more flexibility and time to repay. This enhances the health of their loan portfolio, as we see an average repayment rate increase of 30% with flexible loan programs.

How to get started with a SaaS lending platform

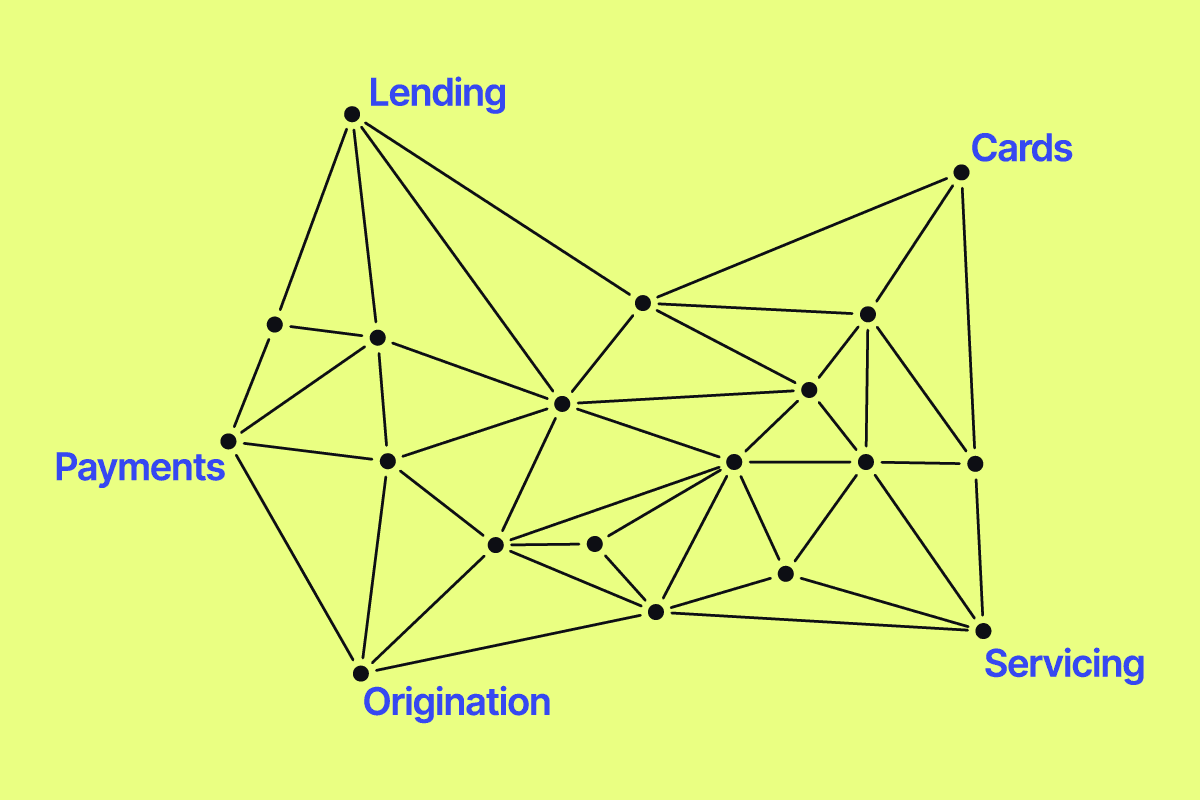

Canopy is a SaaS commercial lending platform that acts as the core of your lending program. While our system handles backend operations and flexible loan servicing, we seamlessly integrate with partners for other parts of the lending process, like origination, underwriting, and payment orchestration.

Integrating Canopy’s SaaS lending technology allows you to create a complete lending program through our product and integrated partners. You’ll be set up with a modern lending core with the ability to scale and, of course, a new revenue stream that will also help you close more deals.