Small business lending is a dynamic market full of challenges and opportunities for lenders and business owners. As demand for capital grows, small businesses are becoming more open to new and more innovative ways of obtaining capital, and lenders are responding to the call.

Traditional lending channels present obstacles to small businesses, such as lengthy approvals, high costs, and stringent requirements, which opens the door to alternative financing providers.

This post examines the current state of small business lending in 2025, the biggest problems SMBs face regarding financing, how alternative lending solutions are filling the gaps, and where the small business lending market is heading.

Key takeaways:

- The small business lending market is dynamic and growing, driven by increasing demand for startup and recovery capital.

- Small businesses face challenges accessing funding due to confidence issues, high costs, and lengthy approval times.

- Alternative lenders and online platforms are gaining traction by offering faster and more flexible solutions.

- Technology is crucial in shaping the future of small business lending, and API-first solutions are expected to gain a significant market share.

The current state of the small business lending market

While there are many types of small business loans, SBA loans are a good indicator of the small business lending market as a whole, mainly because they are closely tracked.

In 2024, the SBA approved over 70,000 loans for a total amount of $31.1B, with an average loan size of $443,000. That’s a 13% increase in the total amount from 2023 and a 22% increase in the number of approved loans.

While 2024’s SBA numbers show significant growth, that’s piling on top of the growth from 2022.

Despite this growth, small businesses face significant problems finding the loans they need in a timely matter, which opens up opportunities for lenders willing and able to fill those gaps.

Problems that small businesses face in lending

Confidence in traditional lenders is a mounting concern for small businesses. Many SMBs operate in a fast-paced business environment, where cash flow is variable, and bills pile up before invoices or payments come in. When it comes to obtaining a loan through a traditional source, small businesses face familiar challenges:

- 44% of SMBs did not apply for a loan because they felt they would not qualify or be denied.

- Only 14.6% of SMB loans were approved by big banks (Small Business Credit Survey).

- Nearly two-thirds of small businesses lack access to a business credit card (PYMNTS).

- Small businesses with over $1M in revenue and those in urban areas had more access to credit than lower-revenue businesses and those in rural areas (PYMNTS).

Many small businesses simply refuse to use credit to grow their business, even though access to more capital could help them achieve more and be more likely to survive through harsh economic conditions.

Lending costs are high, but alternative loans offer lower costs

As shown above, the number one reason small businesses avoid credit is due to high fees and interest rates. These high costs hold small businesses back and keep them small, as they lack access to the capital they need to expand.

Here are some costs we’ve seen associated with the different types of small business loans:

- SBA 7(a) Loans: 11.5% to 15% (variable), 13.5% to 16.5% (fixed)

- Traditional Bank Loans: 6.25% to 9%

- Business Lines of Credit: 3% to 39.90%

- Online Loans: 3% to 60.90%

- Merchant Cash Advances:1.1% to 1.5% factor rate

- Invoice Factoring: 1% to 6% factor rate

Source: Canopy internal research and customer conversations

More and more small businesses are turning away from traditional banks and towards new sources of capital that offer faster access to loans at a lower cost. Many of these are fintechs, embedded lenders, and other non-bank lenders that use innovative products such as merchant cash advances, working capital loans, and invoice factoring to offer fast capital at lower costs.

Alternative (non-bank) lenders vs. traditional bank lenders

A significant issue that traditional bank lenders and even SBA loans suffer from is slow processing and disbursement. Small businesses, especially those with working capital needs, don’t always have 90 days to wait for a loan to come in. This is more true for those working in tight-margin or seasonal industries where revenue comes in waves.

Where the small business lending market is heading

Small business lending is a growing market, and new types of digital and embedded are accelerating that growth.

Globally, the small business lending market is expected to grow at a compound annual growth rate (CAGR) of 13% from 2024 to 2032, reaching a $7.22 trillion market size. Fueling that growth is new digital lending solutions offered by non-bank lenders. The digital lending market is expected to be worth $20.5 billion by 2026, about double what it was in 2021.

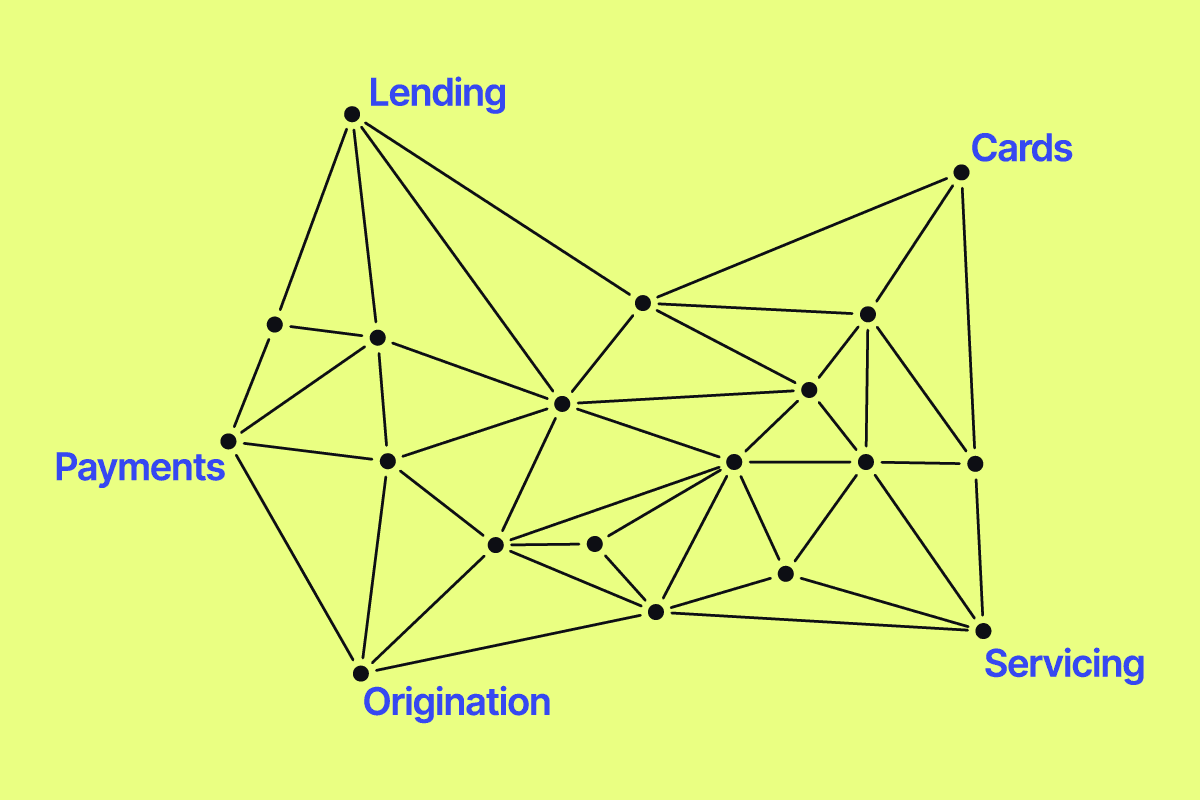

Embedded lending, where non-financial companies offer loans to their existing customer base through their own platforms, is also exploding.

While some embedded lending exists in the consumer space, much is done through B2B SaaS companies with deep customer relationships. The embedded lending is already valued at $6.35 billion in the US and is expected to reach $23.31 billion by 2031—a whopping 20.4% CAGR.

Small business lending trends: The biggest opportunities in 2025

Financing is no longer just a necessity, especially for higher-revenue SMBs.

According to PYMNTS, over half of SMBs with over $1 million in revenues are now using financing as a business strategy rather than just as a necessity to stay afloat. This is likely due to the increasing options small businesses have for new types of financing, such as merchant cash advances and working capital loans.

Small business lenders, both traditional financial institutions and alternative non-bank lenders, have tremendous opportunities ahead. However, most of this opportunity will be in new, digital-first solutions, like embedded lending, that enable small businesses to get loans faster, with better rates, and work within the platforms and workflows they already use.

API-first lending solutions that seamlessly integrate into a business’s existing applications and workflows are forecasted to account for 40% of the market by 2026. SaaS providers, fintech lenders, and financial institutions can take advantage of this opportunity by using these new technologies to get loans in front of customers when they’re needed most. API technologies can also help lenders go from application to funded loan much faster, making loan servicing easier and more flexible.

Flexible loan servicing is the ability to alter loan terms and rates quickly and easily when customers are facing a temporary setback but are still expected to be able to pay over the long haul. At Canopy, this is where we expect to see increased momentum. That’s because our customers who use flexible servicing—made easy through the platform—see loan repayment rates increase by 30% on average.

Canopy helps SaaS companies, fintechs, and other non-traditional lenders create seamless and innovative lending programs that take advantage of the tremendous opportunities in digital, API-first lending that lie ahead.

Interested in learning more? Talk to our team about building new loan products or expanding your loan program with innovative solutions.