In the latest edition of our LinkedIn newsletter, The Lending Innovator by Canopy Founder & CEO Matt Bivons, we took a look at how fintech can help small and medium sized businesses as regional banks and the banking sector as a whole are tightening down on credit.

We’ve all heard and talked in-depth about the collapse of Silicon Valley Bank and other regional banks the last few weeks. Something talked much less about is the huge impact this is having on SMBs across the nation, not just technology startups.

Take a look at the chart below. SMBs have been underperforming in the stock market since the SVB collapse, suggesting investors are worried about the negative impact of the ongoing credit crunch on middle market companies.

This isn’t the first time in recent memory that these businesses have taken a hit.

Alternative lenders played a key role during the pandemic

In 2020 and 2021, small business lending faced significant challenges due to the global COVID-19 pandemic and the resulting economic impact. While government programs provided important aid, it was just a temporary fix.

For a more lasting change, we need to look at fintech. Alternative lenders played a crucial role in providing financial support to small businesses during the pandemic. These lenders often leveraged technology and innovative approaches, offering faster and more accessible lending options compared to traditional banks.

Think of companies like LendingClub, OnDeck, and Funding Circle, whom offered online platforms that connected small businesses with investors or lenders willing to provide capital. Or P2P lending platforms such as Prosper and Upstart that allowed individuals or businesses to lend directly to small businesses.

What role will fintech play next?

Now that government subsidies and incentives for lending to SMBs are basically nonexistent, the moment is prime for fintech to be the hero of the story.

How can fintech use technology and alternative approaches to facilitate non traditional underwriting of small businesses?

Three ways come to mind:

-

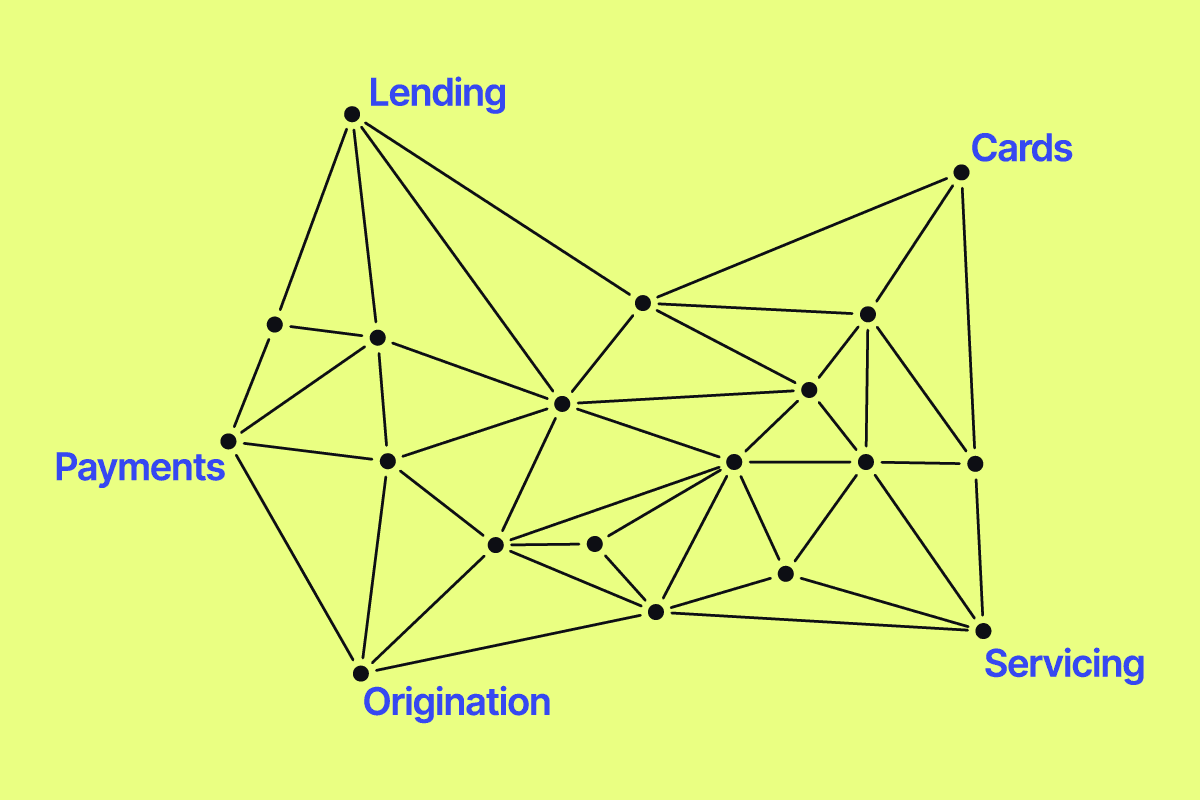

Cash flow and same day payments

-

Inventory evaluation and working capital

-

And of course, AI

Fintech’s time to rise to the occasion

Taking a fresh look at new technologies and untapped or undervalued data points to evaluate borrowers will be more critical than ever before in today’s market. Canopy has the good fortune of being in the trenches with our partners and playing a role in helping them innovate. We see new policies and rules being applied to different B2B use cases every day, while new working capital products are launching to fill a massive void.

It’d be a shame for our industry to let this moment go to waste. Now is the time to rise to the occasion.

Reminder, if you want to get these insights delivered straight to your inbox, go subscribe to our newsletter on LinkedIn.

Written for those building loan and credit products, or just want to geek out on fintech, this new series provides tips and insights from leaders in the credit, lending, and BNPL space.